Texas load is rising fast, supply chains are tight, and the cheapest near-term resource is demand we shape intentionally. But are the right economic signals there to bring this resource to scale?

Texas has a highly competitive power supply market, but the demand side is severely underdeveloped. In my conversation with Travis Kavulla, former Montana PSC Chairman and current leader in retail innovation, we explored how Texas can unlock the cheapest near-term resource by shaping demand on purpose.

Retailers now have both the data and tools to automate flexibility in homes and small businesses. That’s the fastest way to keep bills in check and the lights on during tight hours.

“The incentives are there for sure… when spot prices rise above a flat retail rate, the incentive flips, and it’s valuable for both the retailer and the customer to reduce.”

Smart Meter Texas enables interval settlement, and connected devices like thermostats, EVs, and batteries can now respond automatically. This is finally real.

Retailers are competing not just on price, but on automation. NRG has moved its virtual power plant strategy to the center of its retail offering, pairing Vivint installations with demand response.

“We announced a one-gigawatt goal… and hit 150 megawatts this year.”

That flexibility hedges against the most expensive hours and brings value directly into customers’ homes. ERCOT has also proposed a program, capped at 500 MW, that pays households for reducing use in the tightest hours. It helps offset hardware costs and puts residential customers on more even footing with large industry.

Our system should reward shifting, not just saving — using more when power is plentiful, less when it’s scarce. That avoids overbuilding while meeting growth from data centers, electrification, and hotter summers. Winter risk is just as much a demand issue as supply. Resistance heating drove massive spikes during Uri. Heat pump retrofits can improve reliability and affordability, but without targeted support, private markets may underinvest.

Transmission costs are another sticking point. Large customers can avoid charges by guessing peaks, shifting costs onto everyone else. Residential customers use about a third of the energy but pay half of transmission, which rose more than 120% in a decade. Reforming 4CP so costs align with who drives grid build-out would be fairer.

Texas can build a true two-sided market. Let competition automate flexibility in millions of homes, fix cost signals, and target winter risk directly. That’s how we keep bills manageable, stay reliable, and grow with confidence.

If this breakdown was useful, share it with a friend or colleague, and subscribe so you don’t miss the next Texas-focused grid update.

Timestamps

00:00 – Introduction to Travis Kavulla

02:00 – Introduction to NRG

04:00 – ERCOT competition and demand side incentives

06:30 – The importance of Smart Meter Texas

09:00 – Innovation from competition, telecom and airlines analogies

12:00 – Importance of demand flexibility both from AI and residential sectors

15:00 – Rate design for shifting use

17:00 – Increasing load factors, how using more energy can be energy efficient

19:00 – NRG’s VPP with Google / Renew Home and their progress toward their 1 GW goal

23:00 – Integration with smart home technologies

25:00 – The potential for customers to lower prices

28:00 – Sponsor: Aurora Energy Transition Forum

28:45 – ERCOT’s residential DR proposal, why ERS doesn’t work for small customers

32:00 – Why NRG has broken from other generators to support residential DR

34:00 – REPs in Texas’ energy efficiency programs

38:00 – Can we leverage markets to reduce wintertime outage risk through energy efficiency?

41:00 – Part of the cause of Uri outages was extremely high demand, difficulty

44:00 – Lack of focus from Utility Commissions on demand side

46:00 — Sponsor: Intersolar and Energy Storage North America

47:00 — Utilities are incentivized to spend on capital but not on operations

52:00 – Why and how transmission cost allocation and 4CP should change

57:00 – Closing

Resources

Guest & Company

• Travis Kavulla: LinkedIn

• NRG Energy: Website, LinkedIn

Referenced in the Conversation

• Travis’ University of Chicago Syllabus: Utilities and Electricity Markets: Regulation in the United States

• Book: Prophets of Regulation

• Travis’ ESIG Whitepaper: Why is the Smart Grid So Dumb?

An Audit Report on Critical Infrastructure Activities at the Railroad Commission

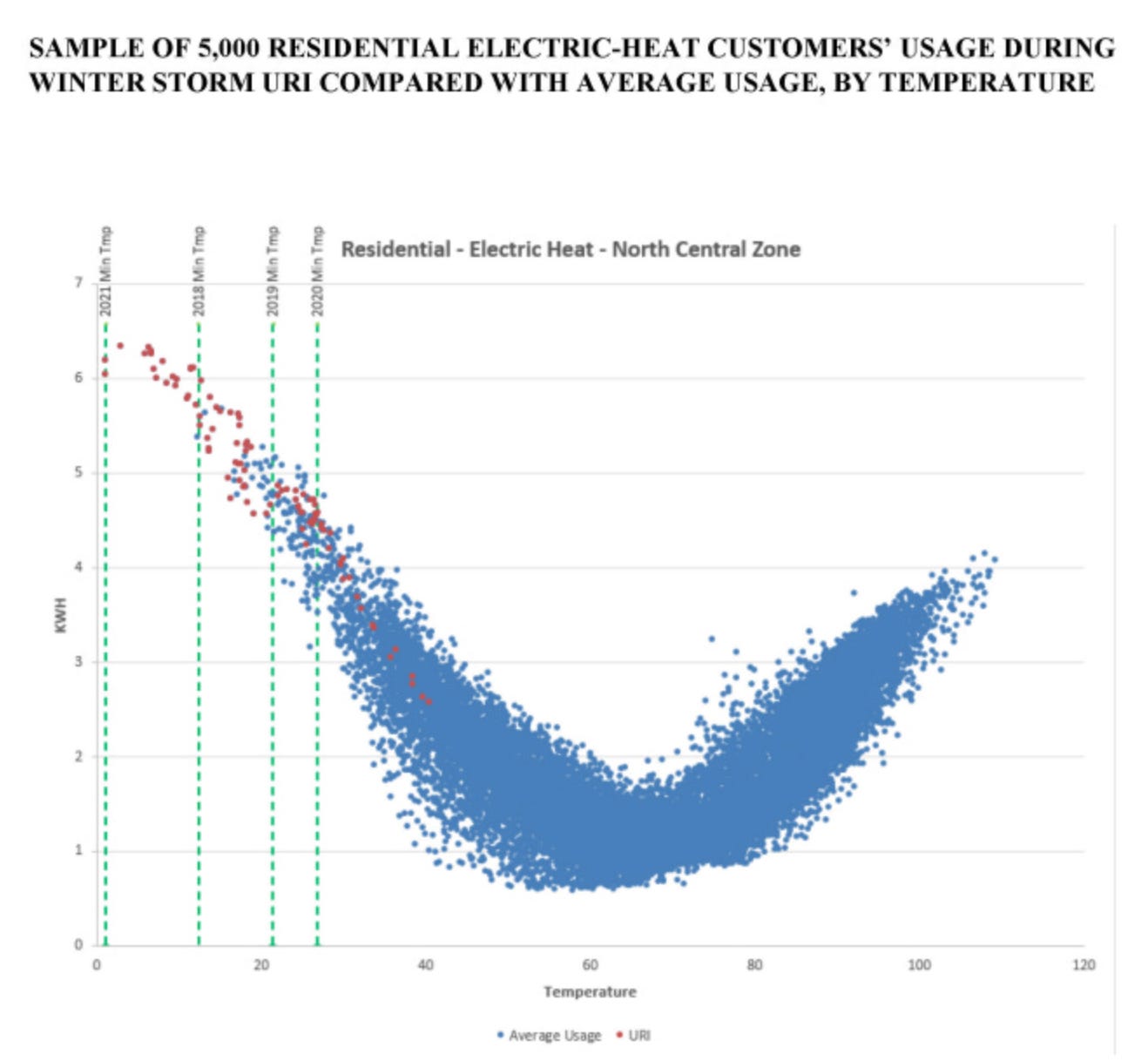

NRG’s filing post-Uri on wintertime demand with resistance heat 100% higher than summertime demand, referenced in my very first Substack article: 2022 Cold Snap Shows Resistance is Futile

Company & Industry News

• NRG, Renew Home, and Google Cloud announce plan for a 1 GW Texas VPP

• NRG to buy 18 gas plants from LS Power in $12B deal (Reuters)

• NRG wins nearly $800M in Texas Energy Fund loans for gas plants (Houston Chronicle)

Related Podcasts by Doug

• The Name of the Game is Flexibility

• Creating a Distributed Battery Network with Zach Dell

📄 Related Substack Posts by Doug

• Texas Load Growth, Challenges and Opportunities

• ERCOT CEO says we need all resources

• New Residential Demand Response Proposal in Texas (Grid Roundup #74)

• Solar, Storage, Gas, and VPPs in Texas (Reading & Podcast Picks)

🌐 Doug’s Platforms

• LinkedIn

• YouTube

• X (Twitter)

📅 Upcoming Events / Sponsor Information

• October 21: Aurora Energy Transition Forum

• November 18-19: Intersolar and Energy Storage North America

Transcript

Doug Lewin (00:05.656)

Thanks everybody for being here and thanks Travis for doing this, really appreciative to SPEER for putting on this great event. As Liz said, I was director of the organization for—I was going to say several years. I think it was many years, five years. It’s great to see the organization growing and thriving and see all of you involved. For those that are listening to the podcast later, we are at the SPEER Industry and Policy Workshop in Austin, Texas. And I’m really thrilled today to have Travis Kavulla here. Travis, I’ve been meaning to interview you for the pod for a while anyway, and I think this is a great setting and crowd to have this conversation because I don’t think there’s anybody better to sort of talk about how retail electric providers, right? A really dynamic market here in Texas with how many different retailers are there?

Travis Kavulla (00:51.534)

80, 100? Many. Many. We love all of our competitors, we love competition, but there are a lot.

Doug Lewin (00:56.682)

Exactly. It’s a very thriving market. There’s a lot of different choice for customers, particularly in the Houston, Dallas, Fort Worth, Corpus Christi, Laredo, et cetera, parts of the state that are served by competition. And to really get into how energy efficiency and distributed energy resources can be advanced using competition and using retail electric providers, I think there’s nobody better than Travis for this. So Travis is vice president of regulatory affairs at NRG. He was commissioner and chair of the Montana—you guys call it the PSC there, ours obviously would be the PUC. He was also president, I believe was the title, of NARUC, National Association of Regulatory Utility Commissioners. So truly a thought leader in this space. Please join me in welcoming Travis Kavulla to the SPEER Workshop.

Travis Kavulla (01:43.822)

Thank you, Doug. Thank you, audience. We need those little things that say, “applaud” up here, I feel.

Doug Lewin (01:50.318)

I’ll just ask. We’ll just do that. It’ll be fine. All right. So first of all, anything before I get into some of the questions I’ve got for you, anything else you want to say by way of intro? As far as your background, maybe actually just like a brief word on NRG. I don’t want to assume folks know necessarily what NRG is. You guys are obviously a very big company, most probably do, but maybe give a little more background of yourself if you like and NRG.

Travis Kavulla (02:11.342)

Sure. So NRG is a retail electric provider in the state of Texas and all other states that allow customers of electricity and in some places gas, though not Texas, a choice in their provider. We’re also a power generator in the state. We sign a lot of power purchase agreements with third parties. And then we have a large natural gas marketing business. And relevant to this conversation, a smart home company that’s one of our most recent acquisitions called Vivint. So we operate basically across the United States, mostly in the competitive markets for power and gas. We have about 8 million customers across North America and a sizable chunk of generation as well. And then you got my bio down, Doug, but one of my passions is teaching. I teach, I’m a lecturer at University of Chicago as well, where I teach on—my syllabus is available for all of you to download for free. It’s a course on utility regulation and the design of electric power markets, which is sometimes not always intuitive. So that keeps me fresh with the youths, I’ll have to think.

Doug Lewin (03:11.278)

Clearly. You know, it’s funny you say that because I actually taught a semester at the LBJ School and I leaned pretty heavily on your syllabus, which is excellent. And anybody wanting to understand the history of regulation of the electric industry and how competition came about, like there’s probably no better place to look than your University of Chicago syllabus.

Travis Kavulla (03:29.866)

I’m pretty great, but I’m wearing the orange socks in your and the venue’s honor today rather than maroon.

Doug Lewin (03:35.394)

We much appreciate that. Thank you. All the Longhorns in the room want to clap for that? There’s only a couple of Longhorns. We’re at the University of Texas campus. Maybe they’re Aggies. So by the way, in the syllabus I used, your “Why is the Smart Grid So Dumb?” was in my syllabus. We’re going to talk about that paper you wrote, which is one of the best papers on this topic. But okay, but before we get into all that, and before we get into NRG’s own plans to have a virtual power plant, let’s just start at a little bit of a higher level. So ERCOT, I think it’s safe to say certainly in America, possibly in the world, and I’d actually be interested in your thoughts on that, is either the most competitive market or one of the most competitive markets. But there’s still a ways to go because what’s missing as you laid out in that great paper, “Why is the Smart Grid So Dumb?”—the demand side, there’s a lot of competition, obviously on supply, very fierce competition going on. There’s a lot of competition for getting the customer, for winning the customer on the retail side. But if you’re going to have this, as you talk about a lot, two-sided markets, supply and demand, that demand side isn’t really there yet. So can you talk a little bit about what is sort of working with ERCOT’s competitive market, how that kind of fits and compares to other markets and that kind of missing piece?

Travis Kavulla (04:50.382)

Yeah, so I always think about these questions in terms of is there an incentive and if there is, can people act on that incentive? So the incentives that are present in the ERCOT market are very real. Most customers in the competitive territory of ERCOT sign up for a flat rate plan of some kind. Some people sign up for time of use plans, but most people are on a flat rate and by that I just mean they pay a retail price of, call it 15 cents a kilowatt hour around the clock. Now the spot price of energy, the stuff we have to purchase to supply our end use customers, the spot price sometimes goes well above 15 cents a kilowatt hour or $150 a megawatt hour, if we’re defining it in megawatt hour terms. And when that spot price rises above the average retail rate of revenue that I would collect as a retail electric provider, the incentives switch over. We go from suddenly being a retail electric provider where I’m usually wanting to sell you more of the thing to make more revenue and more profit to having the opposite incentive. Suddenly, if I could, I’d like to actually not have you using that electricity because my cost is actually exceeding the amount of revenue I’ll collect from you. But that’s obviously not the typical thing. We’ve signed a contract and you have as a customer an unlimited option to use as much energy as you care to for 15 cents in my hypothetical example per kilowatt hour. But when that gap grows wider and wider still, it suddenly produces enough possible cost savings to make it worthwhile for me to rebate something to you to try to reduce your consumption. And it’s worthwhile for you, who would ordinarily probably be unconcerned about taking affirmative actions to reduce your use—it becomes worthwhile for you to do so. So the incentives are there for sure. And then the question is, can people really act on them? And in previous iterations of responsive demand, the answer would have been no. You didn’t have the metering to be able to register people’s consumption on any kind of a real-time basis. And then you wouldn’t have the back office settlement equipment software to actually process people’s bills on that kind of interval basis. That problem has been overcome in Texas. Smart Meter Texas retains and compiles a central repository of all smart meter data and you can read and settle people’s bills on that minute interval basis. Then the question becomes, well, do we have the technology? Is there sufficient automation in the system to allow people to do this so that they’re not having to take manual interventions that they wouldn’t do or would annoy them? But is there something automated in the system where, say, their smart thermostat can automatically respond or be subject to dispatch instructions from the retail electric provider to be able to adjust the temperature in a way that doesn’t require affirmative customer interventions, but with their overarching consent? That problem has also increasingly been solved. And we also finally see the flourishing of a lot more distributed energy resources in this market. Electric vehicles, home battery systems, rooftop solar, and other types of equipment that have turned consumers gradually from being kind of a passive demand side into being much, much more active. And the final ingredient to this is the fact that you do have this competitive retail market where suddenly retail electric providers are not just competing strictly around kind of the average retail price or on marketing, but on what kind of cool things they can get into your home and automate. That’s become a really important characteristic and in fact is the defining feature of certain REPs that we see entering into this market. And that actually, that last thing is what makes Texas really unique. You just don’t see that really nowhere else in the United States and only in a few places around the world. It’s pretty cool what’s going on here.

Doug Lewin (08:45.198)

Yeah, and I think a lot of that, Travis, and I know you obviously work all around the country, is a lot of the regulators in different markets are not sort of willing to kind of trust that function, that consumers can shop, that consumers can make informed choices. Obviously, you need consumer protection there and all those sorts of things, which I would argue Texas has. It can always be improved, can always be iterated on and made better. But at the end of the day, customers in Texas can now choose between, and I’m going to do something that’s like impolite and rude and name some of your competitors, but like some of them have been on the podcast before, Base Power, Octopus, David Energy, Tesla has its own retailer, right? So you see this—like there’s many, many more. I encourage people to go look at Power to Choose. You can see all the different offerings that are there, but what you’re talking about here, right, is this move from kind of a pure commodity, like I’m just delivering you a kilowatt hour and you’re competing to get one tenth or one one hundredth of a penny lower, to services—do you want a battery at your house? Because you’re getting tired of having outages. Are your bills consistently high and you’re worried about energy efficiency? Like retailers can offer those services and find that market fit. Right?

Travis Kavulla (09:58.21)

That’s right. And when regulators and policymakers decided to demonopolize these markets, they usually did so in tandem with telecom, which is, I think, a relevant example. And there were lots of debates. A lot of people skeptical of the demonopolization of AT&T, for example, questioned whether there would really be consumer interest and consumer protection. Why would people be interested in aggressively shopping around for long distance calling service? It just wasn’t that exciting. But we saw in the liberalization of the telecom market a technology revolution that ultimately ended in smartphones and a complete transformation of that industry. Electricity has well lagged behind that. But I think in the emergence of these distributed energy resource-based retail offerings, you’re beginning to see a trend line happening on the power side that has been consummated on the telecom side. So very exciting time to be in this industry for that reason.

Doug Lewin (10:54.762)

And you actually, I think through the University of Chicago syllabus turned me onto the book, Prophets of Regulation, P-R-O-P-H-E-T-S, Prophets of Regulation. It had a whole chapter, which is great, on Alfred Kahn from New York. And like people forget, I was talking to my kids about this the other day and I’m not quite old enough to remember this though it did happen during my lifetime. Many people in this room will remember this. There was a time when the government decided exactly how many planes could fly from point to point per day and exactly what the price would be. Right. And it was actually a Democratic administration under Carter that changed it. So we’ve seen in a number of different industries that competition can have all kinds of benefits. So what I want to get into next, Travis, is I think everybody’s hearing, if you’re around electricity, you’re around the electric industry, you’re hearing about data centers and this big load growth. It’s not just data centers, right? We’re seeing industrial electrification. Summers are getting hotter. So we’re seeing increased air conditioning use. We’re getting all of these different rising loads, transportation, on and on. But data centers is kind of the one driving the conversation and understandably so. I had a podcast with Tyler Norris a couple of months ago about his paper with his team at Duke that focused on if you had, I think the number was something like 1% of hours of data centers were flexible, you could free up a hundred gigawatts of capacity, like roughly 10% of the peak demand of the United States. In Texas, that number was 15 gigawatts, which is actually closer to 20% of peak demand. But everybody’s kind of focused right now, Travis, and not in a bad way, but I think maybe in a too limited, narrow way of not seeing some of the other possibilities, on the data center flexibility themselves. But the flexibility doesn’t have to just come from data centers. It could come from residential customers and small commercial customers. So take any part of that that you want, but I would love for you to talk about why at this moment with rising load growth is flexibility on the system, demand response, DERs, all those kinds of things, so important?

Travis Kavulla (12:53.91)

Yeah, I mean, we could have a long discussion about how much demand is going to grow, but we can probably stipulate for the purposes of this conversation that it will grow, right? And it has been growing, right? In most parts of the country, it’s a question of are we going to reverse a trend of decline and see growth? In Texas, it’s like how much more compound growth are you going to get year on year? And even if one-tenth of the ERCOT market forecast materializes, that is a step change in terms of demand growth in this industry. But then when you look to the question of what will supply that incremental growth? You know, it’s no secret that supply chain challenges, be it in the labor force, in turbine equipment, in batteries, is a real challenge. I mean, NRG is going to be bringing online new power generation, three gas plants over the next couple of years. But we were able to do that because we were paying for a place in line with one of the major turbine manufacturers for a good long while before that. So I’m confident that supply will eventually be able to catch up to demand, but the low hanging fruit really is then demand flexibility in the meantime. And you’re going to see emergent price signals from the ERCOT market that really begin incentivizing demand response in a big way. And to your point, it really, in a sense, it doesn’t matter where demand growth is arising from, because we’re all in this market together, right? So demand flexibility that comes out of a residential, a small commercial business, or a data center has the same rate of compensation, but different levels of obtainability, I suppose, within this market. And that’s what’s really created a focus for us recently on residential demand response, because we actually see that due to the technology transition I was earlier describing as being largely untapped relative to some of the larger commercial and industrial premises where demand response is a much more mature industry.

Doug Lewin (14:52.566)

And part of that is the incentive structure that exists right now. So, right? Like you were talking earlier about the 15 cent flat rate, right? So what is part of that for the customer and for the retailer that you cannot avoid is the flat rate for the transmission distribution charge, right? So it doesn’t matter whether it’s two in the morning, four in the afternoon, or it’s a winter morning or sun is going down and things are really scarce on the grid. Four or five, six cents, depending on what part of the state you’re in is flat for T&D. And you’ve written about that again in that great paper, which I can’t recommend highly enough. “Why is the Smart Grid So Dumb?” You had this phrase, “smart meters, dumb rates.” So, which I love. In Texas, like there’s some ability to deal with that with retailers and you see this, most of it’s probably nights and weekends, right? That’s probably the most common offering in Texas for those that are listening that aren’t from Texas. You can get these rates that are like basically free at night. I don’t actually live in a competitive area, so I don’t actually know, but something like that.

Travis Kavulla (15:54.208)

Buy a different house in a place that was competitive. I mean, come on. I know, that’s right. And to that point, I mean, there are some time of use offerings in the market. They tend to be free nights and weekends. But in general, rather than handing down the time varying price signal directly to the consumer, you instead have what we’ve seen in the retail market here anyways, is that you have properly incentivized retailers acting around the incentive that I earlier described, and they will take on the onus of automating sources of demand flexibility and try to capture that incentive, passing along savings then to consumers in the form of an adoption rebate or an ongoing rebate or a lower retail rate.

Doug Lewin (16:36.194)

Because I think really where we’re headed with this, and you were talking earlier about like if only one tenth of the demand projections of ERCOT, because ERCOT’s projecting I think 65-ish additional gigawatts of demand in the next four or five years, which is insane, right? Like an 85 gigawatt peak going to 150 in four or five years. But I think too often what we’re not talking about are the number of terawatt hours. So if we can start to—and this is where like the comparisons to some other industries get kind of interesting, right? Because when the airlines were fully regulated, it was very common to have 30 or 50% capacity. How many people have been on a plane lately with 30 or 50% capacity, right? Like they’re usually full, especially the longer you go, the fuller they are. So we need to be thinking about that. We have a system in ERCOT, which again, I think a very efficient market overall, still like 53% load factors. So really what we’re talking about here is designing rates that actually incent more use. And I know I’m in an energy efficiency crowd, I know this is a little bit—

Travis Kavulla (17:35.982)

Gonna get something thrown at you, Doug.

Doug Lewin (17:39.352)

But I would argue, and I am as big in energy efficiency, I’ll put my energy efficiency bona fides up against anybody. I am a deep, deep believer in energy efficiency. Part of energy efficiency is using more when that electrified use is more energy efficient. Transportation’s a great example. You’re not losing—and there’s all sorts of industrial applications. You don’t want to lose that waste heat. So really what we’re talking about here is trying to use more when there’s plenty and less when there’s not, so that we’re not going all the way up to 150 gigawatts in four years, but we’re still seeing all this growth in use, not necessarily peak demand.

Travis Kavulla (18:17.89)

Yeah, that’s right. So the system has a ton of fixed costs embedded in it, right? That don’t vary regardless of how much energy is used on the system. And there’s sort of a great division problem at the heart of utility regulatory economics. And it’s pretty simple. It’s math even I can do where you take the total dollars of fixed costs and you divide it by how much throughput there is on the system. And the quotient is the rate. That’s how much on a per kilowatt hour basis you’ll have to pay to recover the fixed costs. So the more volume you can use relative to those fixed costs, without tripping over and incurring a lot of additional fixed costs, the more efficient the system you have.

Doug Lewin (19:00.842)

Meaning lower cost because you’re spreading those costs out. Yeah. Okay. So that is all a big setup to, I think what I’m sure a lot of people in the audience and listening wherever they’re listening to their podcasts want to know about is NRG’s big plans for a virtual power plant. Because that really is like, that’s what a virtual power plant kind of is. It’s two things, right? It’s adding that supply in some cases, if you’ve got batteries or you can use an EV or that demand response can act as supply. But again, as you wrote in that, “Why is the Smart Grid So Dumb?”—part of the problem is we’re always trying to treat demand like it’s supply. And so part of what you’re also trying to do is treat demand like demand and actually shape it. The podcast I did with Jigar Shah, Blake Reketa said, “shape load perfectly, inject supply optimally.” Right. And so that’s really what a virtual power plant is kind of doing, like bringing up use during those lower points, bringing it down during the higher points, and where there is a battery or something like that, injecting it at just the right moment. So you guys are going down this road in a major way in a partnership with Google. You have a goal to get to a gigawatt by 2035. I’m hopeful you guys are going to hit that even way ahead of 2035. But talk about what is that offering and what it means for customers.

Travis Kavulla (20:16.556)

So since 2013, NRG has been allowing people to bring their own smart thermostats or to buy one as an incentive to join our retail electric provider’s demand response program. But candidly, it was always kind of a side program adjacent to some of our retail offerings. And last year we decided instead to put that really in the center of our retail electric offerings into the market, announcing this one gigawatt goal with Renew Home. And what really makes it work for us, I think, is the acquisition of Vivint, the smart home company that has a strong base of employees who can actually go out and install demand response-enabled smart thermostats into people’s homes. We’ve probably all had this experience. I know I’m enrolled in my utility’s energy efficiency program, which gives me like a free box of light bulbs occasionally that arrives on my doorstep, like in a FedEx package, whether I need them or not. And I hate to admit it, but the last box I received, I think four years ago, is still sitting there unopened and it’s now the stand for my laptop so that people are not having to look up my nose on Zoom. It is being used for its socially optimal purposes perhaps, but so being able to actually ensure that from the warehouse to people’s homes, you have this installation taking place gives us a lot more confidence in our ability to reach a goal like that. And then when we think in an increasingly supply constrained, candidly more expensive market environment for supply, we consider our virtual power plant really as a hedge against demand. Because you really, you know, when you begin thinking about this as a substitute for a gas peaker or for the purchase of an on-peak block of power that doesn’t actually fit very well against people’s air conditioning use trend, or against battery drawdowns, those things have an awful lot of capital expenditures behind them. And yeah, so do smart thermostats, but those smart thermostats look in some ways like a much better fit, a much better hedge against residential consumption than any of those other things, which are much more capital intensive. So to your point, you know, we started this, we announced this last year. This year we hit 150 megawatts of the goal, which is a ramp up several times our original expectations of where we would be in 2025.

Doug Lewin (22:47.522)

You’re already at 150 this year for 2025. That’s 2035.

Travis Kavulla (22:52.334)

I am prevented from making any statement as well. I mean, the current retail offering we have out there, and I think one of the reasons it has succeeded is that because people—I mean, we are all interested, I’m sure, in our smart thermostat and I have an app for my smart thermostat and I’m constantly adjusting it remotely. But most people don’t take the same kind of pleasure in just adjusting their thermostat all day long on their phone.

Doug Lewin (23:20.098)

You are a little different in that respect.

Travis Kavulla (23:22.268)

So our retail offering that’s in the market now we call Vivint Home Essentials. And in addition to getting the thermostat, people get a doorbell camera where you can watch people come and go for home security purposes or knowing when packages are arriving. And you get an app that, let me tell you, our engagement with that app, people check it on average more than a dozen times a day for the doorbell camera, but not for their energy use. But it is also the gateway into people taking a more active role in understanding their energy use. And it’s what gets people in the door to get that smart thermostat to begin with. And as long as you are an NRG retail electric provider customer, you get the Vivint Home Essentials package for free. So again, I think it’s one of these innovations you see arising from a competitive retail market, and it’s allowing us to gain trust and customer retention and value to customers, not just in the energy space, but across a wider economy of smart home in a way that plays back and adds value to them on the energy side and ultimately reliability to the grid.

Doug Lewin (24:33.07)

Yeah, that’s amazing. So 150 megawatts, obviously not a small number. That’s a good chunk. So, and yeah, 15% of the way to your goal for 10 years from now. I also just want to just dive a little deeper into the point you just made when you’re thinking as a load serving entity, because this could apply, by the way, also to municipal utilities and co-ops. They’ve got a load to serve. They’ve got to go to the market and find that block that is going to serve that customer in those really difficult to serve times. Maybe the sun’s going down and it’s 110 degrees out. It’s a winter morning, all those kinds of situations that cause a lot of panic and stress to people that are serving load in the industry. You can go out and buy that. You could build, buy. There’s lots of different things you can do, but this option, not only could it actually be better suited because you are bringing in this sort of untapped resource in the form of demand response. It’s also then that the customer is receiving some remuneration, whether it’s the thermostat itself or some ongoing payment. And one can sort of envision as this develops and becomes a more mature market, as markets are wont to do, you start to see where customers’ prices are, right? Some customers are just very willing to—like, maybe they’re not at home a lot. They travel a lot, you know, it’s just a very low price to reduce on that peak. Others are like, I have an elderly family member or whatever. There’s a price, but it’s going to be higher and maybe you’ve got to pre-cool my home for that. And those market preferences start to get discovered and all that’s interesting. But I think the main point I want to make is where that capital is flowing is then into the customer. That’s huge, right? Especially as, as you said, prices are likely going higher as we’re getting more demand on the system. Affordability is a huge problem all over. And Texas has pretty low rates, but we have pretty high bills because of usage. So are you guys seeing that? Are customers actually able to reduce their bills yet? Or at this point, is it more like get the device and then the savings are coming later? What are you seeing in that?

Travis Kavulla (26:42.646)

Yeah, I mean, people are able to monetize their demand flexibility right now. And it’s, you know, not just us, but other retail electric providers who are exploring ways to do this. But I agree with your hypothesis that we’ll see increasingly more depth into what people are doing in that way. For now, it has just been an important psychological change. I mean, to be fully candid, I started with NRG six years ago and, you know, I joined a company that thought of itself as a power generator. And our corporate DNA, whatever it once was, it really is not that anymore. I mean, we—very kind of quick change in our DNA. And I think now we view ourselves as just much more customer centric. And I think that will be to the great advantage of big interests in this market to stop thinking of themselves as people who are producing something for the passive consumption of a big group of customers and really thinking about what customers need, what they want, how you can more efficiently serve them in a challenging market environment.

Doug Lewin (27:46.956)

More energy services than merely energy supply. Absolutely. Okay. Before we get back to the conversation, a quick word from our sponsor. The second annual Aurora Energy Transition Forum is returning to New York on October 21st. Participate alongside senior leaders from utilities, finance, government, and technology to address America’s energy transition challenges and solutions. You can explore grid reliability, AI’s impact, capital flows, and strategic investments all in one high-level gathering. You can register now and also find Aurora’s excellent research, including several great presentations on Texas and Texas energy at their website, www.auroraer.com. That’s A-U-R-O-R-A-E-R.com, and we’ll have a link in the show notes. Now let’s jump back into the conversation. All right, so I don’t know how much folks in this room are following this, but ERCOT has put forward a proposal to get more demand response. So to its credit, ERCOT as an institution has figured out that in order to really have a—you can fill in the blank with a lot of different words—reliable, resilient, affordable, sustainable, you put a number of different words in there, you do need this two-sided market, you need demand. So they have proposed NPRR 1296. Can you talk a little bit about what that program is and what your thoughts are? Obviously, it’s going to go through different iterations. It’s going to change. But as it’s currently proposed, what are your thoughts?

Travis Kavulla (29:18.71)

Yeah. So ERCOT has an existing demand response product, ERS—

Doug Lewin (29:24.558)

Emergency Response Service.

Travis Kavulla (29:35.058)

Thank you, Doug. And it’s safe to say that even though it’s hypothetically open to all customers, that really it has been taken up by larger commercial and industrial customers.

Doug Lewin (29:35.058)

And as a matter of fact, at the ERCOT board meeting a couple days from when we’re recording, this will happen next week, 22nd, 23rd, something like that, there is a slide on ERS that shows where it’s all going and about half is Bitcoin. And then there’s lots of small slices. And I didn’t see any of those slices named residential.

Travis Kavulla (29:52.962)

Right. So the proposal we’re talking about is ERCOT’s attempt to make things, I think, a little bit more equitable and participatory for residential customers in their market. Candidly, it’s not a large proposal. It’s 500 megawatts capped, or if you translate it into volumes, 9,000 megawatt hours. But what it would do is make some kind of a payment when during the tightest supplied hours, the peak net load hours, residential customers reduce their consumption relative to a representative sample of customers. So because of smart metering, you have a very good sampling cohort of residential customers. And when the group of enrolled residential customers in this program reduce their use during tight hours of supply, their retailer would be paid a bonus in essence, augmenting the value of this demand response into the market. I think that’s an important step because it does put residential customers on a more even footing with the large commercial and industrial customers. It also addresses one problem that does exist in this market for residential demand response. And it’s a feature, not a bug. But, you know, of course the premise of competitive retail markets is that customers can choose and customers are frequently choosing to go back and forth between retailers. What that means for retailers who are making investments in smart thermostats is that if I give a customer a smart thermostat for free, pay for someone to install it, and then the next year the customer, as is their right, chooses to go to another provider, I’ve just stranded an asset. And maybe that year was a weak one in the energy market, so the smart thermostat didn’t actually pay for itself. You end up losing money. So this is a revenue stream that is an offset, I would say, against some of the hardware costs that are necessary to facilitate residential demand response en masse. Retailers are going to still have to bear a lot of their own program operating costs, a big chunk of the hardware costs. But this is sort of a nudge realizing that it’s unlike a power plant where, you know, the power plant can’t just grow legs and walk away from you. I own it for goodness sakes. But realizing that the capital stock in smart thermostats and other DERs doesn’t work the same way, this is a little nudge to get that over the hump. And, you know, looking at it, and we’ll have a study coming out soon, you would see a lot faster still adoption of enrolled smart thermostats in retailers’ programs. If we did this, it would probably double or triple the gross margin available to pay for program costs and to rebate to customers. So it’s a big step in the right direction. There are disagreements about it, and this is an example, frankly, of where NRG has departed from some of its generator brethren. I think if you’re looking at this as a pure power generator, you’re saying, well, wait a minute, that’s going to erode the scarcity prices in the ERCOT market that are intended to send me signals for my investment in power generation. And although I, to some degree, agree that it will have a somewhat erosive effect on those scarcity prices, I ultimately get myself on the side of this program because we are really in an all hands on deck moment. And I might not feel this way if we were not living in a moment of profound demand growth, but right now it seems prudent, is the word I would use, to really have programs like this. And I think ERCOT actually deserves some credit for not just having, as we’ve often seen, a bunch of little programs that function to funnel money to large customers or to generators without paying any attention to the possible contributions to reliability of residential customers. It’s really great to see them taking a leadership role in that respect.

Doug Lewin (33:34.382)

Yeah, I agree. So you said that program, it’s going to be 500 megawatts, right? I think they’re capping it at 500. You said with your VPP, where you aim to get a thousand by 2035, you’re up to 150 in the first year or second year, whatever it is. And you’re just one retailer. I think the main thing I’m thinking about with this is just as we need flexibility in the market, I’m hoping ERCOT will be flexible with its design because I think there’s probably ways to use those dollars even more efficiently to create and/or stimulate markets for load-serving entities, but you can’t learn unless you do. So I’m glad they’re getting started and not just like studying the thing to death. So that’s good. Related to that, again, we’re at the SPEER Policy and Industry Workshop. There’s a lot of discussion here about the utility efficiency programs. Texas has utility efficiency programs that have existed since the market was restructured back in ‘99, or maybe it started a couple years after that, whatever, 2002, somewhere in there. So, over 20 years, a couple hundred million dollars in spending. As a retailer, are you all able to access some of those funds to solve the exact problem you were talking about? It’s like, how do you get the devices in that serve the whole market, even if they leave you? Although, does the next load-serving entity use that? There’s questions there, it is difficult. But how is that working as far as like utilities working with the competitive providers who actually have the relationship with the customer? Because some things, and again, I’m mindful that some folks in the room aren’t from Texas and don’t work here every day. A lot of listeners are from different parts of the country or the world. In Texas, the bill is not generated by that regulated transmission distribution utility. When they get a bill, they see your brands like Reliant or Green Mountain or the others I mentioned earlier, or TXU or whatever the brand is. So that’s the one who actually is interfacing with the customer. What are you guys seeing as far as opportunities there? And what would you like to see going forward that maybe could stimulate more of these demand side resources?

Travis Kavulla (35:37.966)

Yeah, and you’re right. I mean, the whole premise of Texas’s restructuring is that the retail customer relationship is between the retail electric provider and customers. And companies that do distributed energy resources for a living, some of them have decided in their Texas exegesis to reinvent themselves as retail electric providers, even though that’s probably not the business model they would have anywhere else in the country. And that is, again, because of Texas’s leadership role and commitment to having this vibrant retail market. So I do think it’s important to channel activities through that market rather than have, you know, multiple different business models trying to serve people in a retail relationship. You know, credit to CenterPoint and Oncor over the last couple of years, they’ve included in their energy efficiency implementation plans some funding for smart thermostat hardware that channels through the REP. There are similar programs for some of the C&I efficiency programs as well. You know, just in my history of being a regulator myself, the thing that I’m always on the lookout for in these energy efficiency programs is a sometimes, and I’m not saying this exists in Texas and I don’t know much about Oklahoma, so forgive me, but I’ve definitely seen it in other places where energy efficiency and demand response providers working in these utility programs end up not seeing the actual end use customer as their customer because they view the utility as their customer. They’re a vendor to the utility or the revenue comes from the utility. It’s the utility who can hire and fire you as a supplier into that market. And that seems like the opposite of the model that you would want and not one that ultimately is going to produce good outcomes for customers. So I think in the way Texas designs these programs, because I agree with you, I think that there should be some level of public support to address what might be a market failure in certain respects, but I think it would be a mistake not to try to more leverage the competitive retail market and to augment that market and to try to kickstart it and get retailers thinking more about customer-centric solutions. So that’s the frame of mind that I approach those programs with.

Doug Lewin (37:55.19)

Got it. So for those that are interested in these utility efficiency programs and what ERCOT is doing, whether through the DR rollout that they’re just starting, the aggregated distributed energy resource pilot that’s been going on for a longer time, or any number of different issues, there will be meetings coming up over the next couple of years of the Texas Energy Waste Advisory Council. This was from a bill, I think it was HB 5323. It might’ve been a Senate bill that passed, but whatever it was, it will create this council to get into exactly these kinds of issues. Because I do think as we talked about earlier, I’ll read just a very brief quote from that, “Why is the Smart Grid So Dumb?” You said a lot of times the programs should move away from saving energy across all hours and focus on investments that can activate demand at times when energy is scarce. So I think of like everything we’ve been talking about, but also a sort of a pet peeve of mine that most in the crowd will probably know where I’m going next. Resistance heat and heat pumps. This is one of the biggest problems we have in Texas. And I talked about it here at this conference a year ago with Chairman Gleeson of the Texas PUC that we have this major problem of winter nights and mornings. It’s still a problem. And I want to be clear. I think if we got the exact same temperatures and system as Winter Storm Uri, the outages would not be as deep, I do think there would probably be outages. And one of the reasons I say that is there was a state auditor report just out last month about the Railroad Commission inspections of the gas fields. And out of 8,700 inspections, they communicated with exactly two people. Communicated. So that means even like not just violations, just like saying, hey, here’s something you could do better. They only sent two out of 8,700. I’m worried about the gas field still. I think that ERCOT and PUC, as you know, as a generator, have done a really good job with the power plant inspection piece. So there’s three main problems: gas supply, power plants, and then demand. And we still haven’t really addressed, in my view anyway, that demand piece. There are increased utility efficiency programs for heat pumps, but as of the last date I’ve seen, it’s a couple of years old. We’re talking about differences of going from like 10 megawatts of savings to 20. When ERCOT commissioned a study from—I know you’re wearing your Longhorn socks today, but shout out to our Aggie brothers and sisters—20,000 megawatts of economic potential is out there from heat pumps. So what I’m getting at is, is there a way while we’re doing this work on DR, ERCOT’s doing this work on DR, you guys have this VPP—is, I think it’s fair to say more focused on thermostats. Is there a way to leverage competitive forces to get to the permanent DR, the permanent demand reduction in the form of moving from resistance heat to heat pumps, which, and I’m going to turn it over to you. I know this is like the longest question ever asked, but which I would point out is not just a reliability improvement, but affordability too, because in those wintertime periods where you’re using resistance heat, if you’re in an apartment, that 5kW strip is just running. You’re using 5kW flat out through the night. It’s a major affordability issue too. So huge opportunity. So is there a way that we can use markets to actually drive energy efficiency investment and improvements?

Travis Kavulla (41:20.418)

Yeah. So to your point, I think sharp-shooting those summer peaks that tend to occur even within the same summer can produce a lot of savings opportunities year on year because of the design of ERCOT’s energy-only market. I don’t want to call that easy, but that’s something that’s very investable with some of the augments that we’ve talked about before from ERCOT and energy efficiency programs. You know, it’s a lot harder just from a kind of a private capital economics perspective, you know, to justify demand response investments to contour demand, to try to prevent an event that we hope will never happen again. But if it does, it’s likely not going to happen year on year on year. Thank God. And so, you know, when I look at problems of economics like that, that does seem to call for, you know, probably a different approach, more public spending, some kind of justification for some other way because it may not, other than consumers being willing to make private investments directly into heat pumps, you may not see at least the retail electric provider market form around that. But I do agree with you, Doug, that it’s a problem. And I know you looked at some of our load analysis after Winter Storm Uri. NRG studied 5,000 residential customers in the Texas north load zone. These were electric heat customers and they were not interrupted during Winter Storm Uri. They were some of the fortunate ones who were on circuits that were not interrupted, but it gave us the opportunity to see how much electricity they were using. Probably with resistance heat, and at the height of that storm, those customers were using something like two times the electricity that they would be using on like a 90, 95 degree day for air conditioning. So that is a huge amount of electricity usage. And when we look back at Uri, you know, it had two parts, right? It was supply going missing due to fuels and generation. It was also just demand soaring to astronomical levels and not being able to be supplied. So I share your concern and, you know, I don’t throw around the term market failure loosely, but it is difficult to get an energy-only market to make, you know, solid demand side investments to hedge against a one in 10, one in a hundred year, whatever we’re calling it event.

Doug Lewin (43:49.9)

Yeah. And this is something I’m hoping does come out through that Texas Energy Waste Advisory Council and the PUC. Now to its credit, we’ve given some praise to ERCOT. I’ll heap some praise on the PUC too for going from one part-time person a few years ago on energy efficiency to a division of three, three and a half folks working on energy efficiency. So if we can really kind of train those programs on what is that big weakness by getting the solution out there, heat pumps, which then also help in the summer too, right? There’s just, there’s all these check marks where no matter what the box you’re trying to check, heat pumps really check a whole lot of those.

Travis Kavulla (44:27.639)

And a shout out just because I come from a commission background. I know we have some commission staffers here today. Thank you for your public service. And I’ll say, you know, the Texas commission is in the unique position of regulating because it is an intra-state market for generation, both the wholesale market and ERCOT, as well as the demand side. But for people listening to this podcast elsewhere, I often encounter utility commissions and they seem so focused on basically making themselves into a stakeholder complaining about what an RTO that’s subject to FERC jurisdiction is doing on the market design. Sounds awful. And they spend like less than 5% of their time focused on demand side issues, which are exclusively jurisdictional to state governments in the United States, but have really not had an appropriate amount of attention paid to them. They have attention, and I’m getting on the soapbox, and this is the premise of the “Why is the Smart Grid So Dumb?” paper. They pay attention to them when it comes time to make capital investments in advanced metering. But then, and this doesn’t apply to Texas, but a lot of other places, then those advanced metering investments really don’t get used to transform the customer experience in any meaningful way. The capital productivity of those investments is very low.

Doug Lewin (45:43.886)

A quick thank you to our sponsor for supporting the Energy Capital Podcast. Hey, everyone. Doug Lewin here. I wanted to let you know about the InterSolar Energy Storage North America Conference and Expo, which will be happening November 18th and 19th up in Grapevine. On the first day of that, to open the conference, I’ll be on a keynote session, 18th in the morning. It’ll be called Power Policy and the Path Forward: Texas Legislation in the National Context. This is a great place to go if you’re interested in what’s going on in Texas, what’s going on nationally. This panel is going to be incredible. I’m excited to be on it, but I’m definitely bringing the average down. There’s going be all kinds of great speakers on that one. And throughout the two days, I will also be moderating a panel on Texas’s $1.8 billion program to put microgrids and backup power at critical facilities. That’ll be in the afternoon of the 18th and I’m staying through the 19th. So hopefully I will see you there. Let me know if you’re gonna make it. Look forward to either meeting you or catching up there. InterSolar and Energy Storage, North America, Grapevine, November 18th, 19th. Be there. All right, let’s get back to the show.

Doug Lewin (46:50.178)

On the point of talking about public utility commissions and what they do. You do these great presentations. Anytime you do them, I try to go through them, even though there’s some like repetition in there. It’s great as a reminder for me. And I was looking at one you did in, I think it was Virginia recently as different states are sometimes because the legislature tells them to, sometimes by their own volition, commissions are looking at what actually is performance-based regulation. And when you talk about “Why the Smart Grid So Dumb,” the utility, obviously the smart meters are rate-based, right? So you put out the device and you get your nine and a half, 10, 10 and a half percent on all of the smart grids that are put out there. Actually using the smart meters to reduce consumption, to help customers reduce their bill, to make the grid more reliable, those things aren’t necessarily incented though they could be. So can you talk a little bit about, let’s in the context of this conversation, like, are there elements of performance-based regulation that could actually help stimulate some of the demand side activity we’ve been talking about?

Travis Kavulla (47:59.35)

Yeah, I think so. It’s a long putt to get there because we’re starting from a situation, honestly, which looks very different from probably the ideal end state. But yeah, to put it simply, you’re correct. I mean, in most of the United States, basically nearly all states, you have a regulatory regime called cost of service regulation. And the premise is pretty simple. The more capital I spend as a utility, the more profit I make. Spend more, make more. Meanwhile, if I use the capital assets more efficiently that I’ve invested in, there is no additional profit for me. And what it actually might mean is that I obviate the need for future capital investments. So perverse incentive. Don’t want to do that. And there’s a whole family of incentives that are bad that flow out of this. I mean, you will never make more profit as a regulated utility than you will the very first year that you own something. Whereas of course in most ordinary businesses, right, you want to own it free and clear. And then it’s all cashflow from whatever you’re using that capital asset to do. So we’ve managed to bake our way into a system where the incentives are probably not well aligned with consumer outcomes. And in fact, over the years we’ve in certain states, we’ve almost made it worse because the one disciplining factor would have been a lag between the time a utility spent money on capital investments and when they could ultimately start getting it recovered from ratepayers. And nowadays, many commissions have cost adjustment clauses or trackers or factors that basically cause those investments to be recouped almost as quickly as they are made. And that further diminishes any incentive a utility might have to make operating expenditures patch in for what would otherwise be filled in with capital needs. And the final consideration, very relevant to this audience, to businesses like mine as well, because you earn no return on your operating expenditures under cost of service regulation. You get them recouped, but you don’t earn a return on them. It creates an incentive basically for the utility to own literally everything they would need to do rather than to contract with third parties for anything. And if, you know, ultimately they do have to contract with third parties, then they might come in and ask for margin on that too, but typically they would earn no return. So a better way of doing this, and it’s, I think, well documented in the literature, it’s what I had to say in Virginia, you know, is probably to try to put utilities on some kind of a budget and have them manage to that budget over a sequence of a number of years. And that would give them a profit motive, because I’m not saying we should just make utilities behave more efficiently. I’m a great believer in incentives. It would give them a financial incentive to engage in the same logic of trade-offs that every other business in the economy does, deciding whether to do CapEx or OpEx, deciding whether to do it yourself versus hiring someone else to do it. And I think ultimately that would lead to, you know, a much more customer-centric place. This is not to say that the grid doesn’t need a lot of capital investment. Clearly it does. But we want actors behaving and making trade-offs intelligently.

Doug Lewin (51:17.794)

And as I’ve talked about a lot on the pod and written about a lot, the fastest rising part of the electric grid as far as costs is distribution. So, and this is relevant to Texas. We don’t have to deal with the cost of service for generation, which is great, at least within ERCOT. There’s a very active thing, right? With Entergy and then PUC just put a cost cap on their generation in East Texas. But in ERCOT, we don’t have to deal with that on generation, but obviously do on distribution and transmission. So all of what you’re talking about there, those trackers, like all of that exists in Texas. So this conversation is very relevant here. The one last thing I want to ask you about, and it’s not a small thing, but we can at least kind of tee it up. And this is going to play out over the next year, year and a half in Texas, but is the 4CP system. So when you talk about transmission distribution utilities and how they’re actually collecting that revenue from customers, there’s a strong market signal to the very large customers to reduce their use during the four coincident peaks, June, July, August, September. If they reduce that down to zero, theoretically, they could pay basically no transmission distribution charge. You’ve written about this again, this is in that “Why is the Smart Grid So Dumb?” The idea that Texas policymakers had to not have residential customers exposed to that, right, is like, these are not necessarily sophisticated customers to your point. They’re looking at the front door on the app, not the energy use a dozen times a day, and they shouldn’t have to look at energy use a dozen times. They should have to look at energy use no times a day if they so choose. But there are entities in Texas that could have that price signal of reducing at peak. So we are going to go through a process because the legislature has basically told the PUC to review 4CP and possibly redo it, which is going to happen in the second half of next year. Can you just talk a little bit about, again, as a retail electric provider, actually, at least as I read your paper, wanting that exposure and risk because it could bring more of that two-sided market, bring demand into the market?

Travis Kavulla (53:20.718)

Yeah. And I think that might be kind of a future step from where the process is now, but I guess I’ll confine myself for the moment to just talk about the status quo, which I think is pretty unfair. And you’ve described it well, which is that we have effectively faced large industrial customers with an incentive that ranges between what amounts to $10,000 and $20,000 a megawatt hour that they’re able to avoid in costs if they correctly guess and get offline during those four 15-minute intervals of 4CP. And by and by what that has done is created a system where a lot of the fixed costs of the grid are effectively shifted onto other customers. And to your point, those customers have no ability, even if they wanted to, to avoid those costs. And that’s led us to a situation where residential customers in the competitive market in Texas use a third of the energy, but they pay for half of the transmission grid. And this is especially acute because the total costs in the transmission system have risen dramatically, like 120% over the last 10 years.

Doug Lewin (54:27.448)

Transmission and distribution, it’s both.

Travis Kavulla (54:30.872)

Yep. And so three times the rate of inflation. And then we’re now talking about spending another $30 billion in the transmission system, which will double the ERCOT transmission revenue requirement.

Doug Lewin (54:43.246)

So we have to fix that.

Travis Kavulla (54:44.786)

We have to fix it and the legislature deserves a lot of credit for including that provision in Senate Bill 6 to address large load issues and giving it to the commission to kick off. So the first step in this process I think is probably just to fix the upstream allocation of those costs to try to make sure and maybe it’s just going from 4CP to 12CP or something which would bring in—

Doug Lewin (55:07.074)

Winter months, which would be great.

Travis Kavulla (55:09.051)

And we know the grid is not just planned for the summer, right? It’s kind of a year-round thing we’ve got going on here. And so that broadens the base and would lead to a more likely outcome where transmission rates would still be tied in some sense to a demand-based allocation, realizing that some investments in the system transmission grid are related to peaks, but it would broaden the base substantially and lead to a more equitable allocation between residential customers and everyone else. I know it sounds wonky, but this topic is kind of the major affordability issue in Texas energy today because while I know we’re concerned about rising supply costs, ultimately supply costs work on fundamentals. And once you get supply, those costs fall. In my experience, I haven’t seen a lot of regulated costs go up and down over time. They tend to be unidirectional up. So while we’re busy fixing the incentives and trying to control some of those costs to begin with, we should also be very attentive to how those costs are getting allocated. And it’s especially acute. This is my last comment on the soapbox because so much of the incremental spending on the grid is being done on the premise that we need it to serve the growth in large customer loads. So it would be especially wrong to then have an allocation system where the very customers we are building out the grid for are allowed to avoid those costs. We cannot have that in good conscience.

Doug Lewin (56:37.486)

This will be one of the biggest issues at the PUC over the next year, year and a half. And just to go a little further on your comment about the legislature, I also give a lot of credit to the legislature for not trying to prescriptively handle this in legislation, which would have been a mess. So kudos to the legislature for tasking the PUC to do it. Sorry, PUC, but it’s an important job. All right. Thanks to SPEER for bringing everybody together. Please all join me in thanking Travis Kavulla for being here today.

Doug Lewin (57:04.856)

Thanks for tuning in to the Energy Capital Podcast. If you got something out of this conversation, please share the podcast with a friend, family member or colleague and subscribe to the newsletter at douglewin.com. That’s where you’ll find all the stories where I break down the biggest things happening in Texas energy, national energy policy, markets, technology policy. It’s all there. You can also follow along at LinkedIn. You can find me there and at Twitter, Doug Lewin Energy, as well as YouTube, Doug Lewin Energy. Please follow me in all the places. Big thanks to Nathan Peavey, our producer, for making these episodes sound so crystal clear and good, and to Ari Lewin for writing the music.

Until next time, please stay curious and stay engaged. Let’s keep building a better energy future. Thanks for listening.