The full video is on Youtube

Texas isn’t just projecting future load growth; it’s happening now.

Maura Yates of Mothership Innovations set the stage for our discussion at GCPA’s Fall conference earlier this month in Austin.

“We are looking at meters that are 800 megawatts on a single meter… that’s crazy. We used to think 10 megawatts was a big deal…”

She also cut through the headline noise: “The next three years are really critical… This is the them we are hearing at this conference: it’s a near term discussion… We have a big, urgent discussion ahead of us.”

How much of the 200 gigawatt large load queue is real and how much will actually come in the next few years?

Hayden Stanley of Good Peak brought the developer’s eye to the near term. He sees a “whole new layer of infrastructure” coming as the grid gets smarter and more coordinated, but warned that SB6 complexity and behind-the-meter buildouts can slow timelines.

Tom McGinn with EnergyWell focused on “lifting the system load factor” with tools people don’t have to think about, built on “optimizing interval-level usage to respond to price signals.”

He added a sober note: in the next few years, mass-market customers could get squeezed by rising load in the short term, though he thinks in the longer term, Texas will have continued investment in the grid and new technologies and abundance for consumers.

Zach Dell of Base Power Company reframed things taking a much longer view:

You’ve got to make large investments with a long-term time horizon. And I think there are really strong precedents for this kind of orientation in other parts of technology. You saw Uber do it in transportation, Amazon in commerce, SpaceX in aerospace. We’re taking a similar approach to energy where we’re making 10, 20 year investments, both in terms of the technology that we’re developing, but also in terms of how we think about policy.

Base has added 100 megawatt-hours in the short time it’s been in business and is now adding 20 megawatt-hours per month.

Large loads are coming but so is innovation across the grid.

Timestamps

00:00 – Opening

01:00 – Guest introductions

03:30 – Load growth happening now much faster than expected

04:30 – Critical discussions are about the next 2-3 years

07:00 – Smarter grid, higher load factors, new infrastructure layers

09:00 – Potential bearish load growth over the next few years

10:30 – Thinking long term about resiliency and costs

12:00 – Is ERCOT still working to remove roadblocks? Are process changes needed?

17:00 – Smart meters enable design innovation and response to price signals

19:30 – Demand-side flexibility from batteries: “price down, reliability up”

22:00 – Base Power’s scale, the new factory in Austin

24:00 – Gigawatt scale virtual power plants (VPPs)

25:00 – Inflation Reduction Act repeal

26:30 – The advantage of distributed, smaller scale (<10MW) battery projects

28:00 – Senate Bill 6 and the case for a more bearish demand growth case

30:00 – What could slow down load growth

33:00 – Data problems with large load demand response

34:00 – Audience question: Data center water use, closed loop design

36:30 – Audience question: Doug’s one top policy change, would it be a carbon tax?

37:30 – Audience question: Zach- when will you expand to California?

38:30 – Audience question: Will grid tech still advance if there’s not load growth?

40:30 – Closing

Resources

Panelists & Company

Maura Yates LinkedIn, Company Page & LinkedIn

Hayden Stanley - Bio, Company Page & LinkedIn

Zach Dell - LinkedIn, Company Page & LinkedIn

Tom McGinn - Linkedin, Company Page & LinkedIn

Doug Lewin - LinkedIn, YouTube, Twitter, Bluesky, and Threads

Creating a Distributed Battery Network with Zach Dell

For this episode, I had the pleasure of interviewing Zach Dell, who recently launched Base Power Company, the first and only retail electric provider in Texas to offer customers a home battery, monthly energy service, and installation all in one package.

Books, Articles & Podcasts Discussed

Load Growth: What States Are Doing to Accommodate Increasing Electric Demand (EPRI) PDF (Clean Energy States Alliance)

NRG’s Gigawatt VPP in Texas with Travis Kavulla (Energy Capital Podcast)

Shape Load Perfectly, Inject Energy Optimally with Sonnen’s Blake Richetta (Energy Capital Podcast)

The Year the Texas Legislature Changed the Energy Game Forever by Russell Gold (Texas Monthly)

ERCOT CEO Pablo Vegas Board Presentation:

Transcript

Doug Lewin (00:06.464)

It’s great to be here this morning. Hope everybody’s doing great. It’s been a great couple of days. Really want to thank Gulf Coast Power for again putting together such a great event. I think my first Gulf Coast Power was like 15, 16 years ago. This is the 40th anniversary. It’s amazing to see you guys still going so strong. This has been a great conference. I’ve learned a ton, caught up with a lot of people. I am Doug Lewin. I do a couple of different things, but one of the things I do is I host the Energy Capital podcast. We are recording this today and we’ll release it as an episode. For those that are listening later, we are in Austin at the AT&T Conference Center at the Gulf Coast Power Conference. So I have four amazing panelists here. I can’t wait to get into this discussion. We’ve got a lot to talk about, but would each of you just briefly introduce yourselves and your companies so folks kind of know who you are. You want to start at the end? Go ahead, Zach.

Zach Dell (00:58.366)

Hey everybody, I’m Zach Dell. I’m co-founder and CEO of BASE Power. BASE is a retail energy provider and battery developer based here in Austin. Started the company about three years ago. Our mission is to lower the cost of electricity for all. And we do that by developing technology solutions, hardware, software, and the like to help rebuild the infrastructure here on the power grid in Texas and beyond.

Doug Lewin (01:20.458)

And I’ll just say I did record a podcast with Zach. It was like a year ago, more than a year ago now. Two years ago. Was it really that long ago? Wild. So for those that want to know more about BASE, you can go back, whether you’re in the room or listening later, you can go back and listen to that one. Go ahead.

Tom McGinn (01:35.16)

Hi, I’m Tom McGinn. I’m Senior Vice President of Energy Trading at EnergyWell. EnergyWell operates a few different load-serving entities in competitive markets in the US, along with offering software and consulting services to other market participants. I’ve been working in competitive markets for almost 20 years now across all the competitive ISOs in the US, kind of at the intersection of the wholesale and retail functions in those companies. So yeah, happy to be here with everyone.

Doug Lewin (02:03.694)

Thanks Tom. Hayden.

Hayden Stanley (02:05.486)

How’s it going? My name is Hayden Stanley. I’m the co-founder and COO of GoodPeak. We’re involved with building out distributed generation assets in ERCOT. We’re vertically integrated. And we’ve recently also entered the digital realm with data centers. So excited to be here today.

Maura Yates (02:22.466)

Maura Yates, the co-founder and CEO at Mothership Energy and Mothership Innovations. We are a retail electricity provider and ERCOT market service provider to large loads and load-serving entities across ERCOT. So everything from billing and operating services to QSE services, but again, really focusing on large complex loads across ERCOT.

Doug Lewin (02:44.61)

Such a great panel, so much knowledge and experience and lots of different experiences and different businesses represented here. So let’s just start at a very high level with a question I like to ask on the podcast. Zach, I don’t remember if I asked you this one two years ago. I probably did, but it’d be interesting to compare and contrast your answers if I did. It’s one of my favorite questions, which is just to kind of look ahead four or five years. You know, sometimes I think 10 and 20 years is like too far. Who knows? It’s anybody’s guess, but four or five years far enough away that we’re not talking about tomorrow or next week or even next year. You’re looking like a 2030 kind of view. What do you think is really going to change in this Texas market? What are the technologies you’re kind of most excited about? And I think even let’s talk a little bit about what are some of the roadblocks and obstacles to getting to that vision. You want to start?

Maura Yates (03:32.526)

Sure. So for those who know me in the room, they know that I’ve participated in the market for a while and done everything from resi in the kilowatts all the way up to now megawatts and gigawatts. So we’ve seen this really crazy, interesting evolution, especially the integration of renewables into ERCOT. And I was reflecting with somebody last night about where we saw the market in 2013. 2025 was so far out. And did we see where we were, you know, 12 years ago? And I think in general, we kind of had a sense, yeah, this is where we were going to see a lot of renewables come online. We had a good idea of where generation was going, but I don’t think we had a good idea of where load was going. Obviously the latest incentives to move business to the state have really helped drive that. And not only did we not see where load was going, we didn’t see the scale at which load was going there. Like we are looking at meters that are 800 megawatts on a single meter. That’s crazy. That’s insane.

We used to think 10 megawatts was a big deal. Now 10 megawatts is like, I don’t know if we have time for 10 megs. That feels really small. So I mean, we’ve seen this really, really rapid shift and this change in trajectory in terms of where we’re seeing this market go. And so when we talk about the next five years, it’s really interesting. It’s going to be, I think, much faster the rate of change than what we’ve seen perhaps the last five years. We saw the last five years coming. I don’t know if we saw the next five years coming. So when I think about what’s going to happen, I think the next three years are super critical. The next three years will dictate what happens in five years. So when I really think about what I’m focusing on or where Mothership is focusing, we are focusing on the next two to three years and say, what is going to happen in the next two to three years? Because that will absolutely determine what we see in ‘28, ‘29, ‘30. And again, I think this is the theme that we’re hearing at this conference, largely a conversation about the queue and what’s going to happen with large loads, what’s happening as a result of SB 6. This is the conversation. It’s a very near-term discussion. It doesn’t mean that all the other discussions don’t need to keep happening. We need to keep having the conversations around how do we manage our really elastic peaks with residential volatility.

We still need to have those conversations, but we have this really big urgent conversation in front of us of, what do the next two to three years look like? Because that will then dictate the tale after that. I mean, 190 gigs in the queue, we know that’s not real. Like, that’s not what our future looks like in the next five years. What part of that is real? Maybe 5, 10%, maybe 10%, maybe 15%, maybe 20%. What do we actually think generation can keep up with? What is practical? What is feasible? And so I don’t know what’s going to happen in the next five years. Every month we get closer to that five-year benchmark, I’ll be a little bit more willing to wager. But right now, I see the conversation of, we have a jam. We can’t get to the numbers that we’re talking about by 2030. We’re too jammed up. If I think maybe another 10, 15 gigs by 2030, maybe in the next two to three years, three, four or five gigs, I don’t know. It depends on again, how we handle and how we manage through the stuff that’s jamming up right now. I think this gets to the innovation conversation that we can talk through more later, but yeah, two to three years.

Doug Lewin (06:42.956)

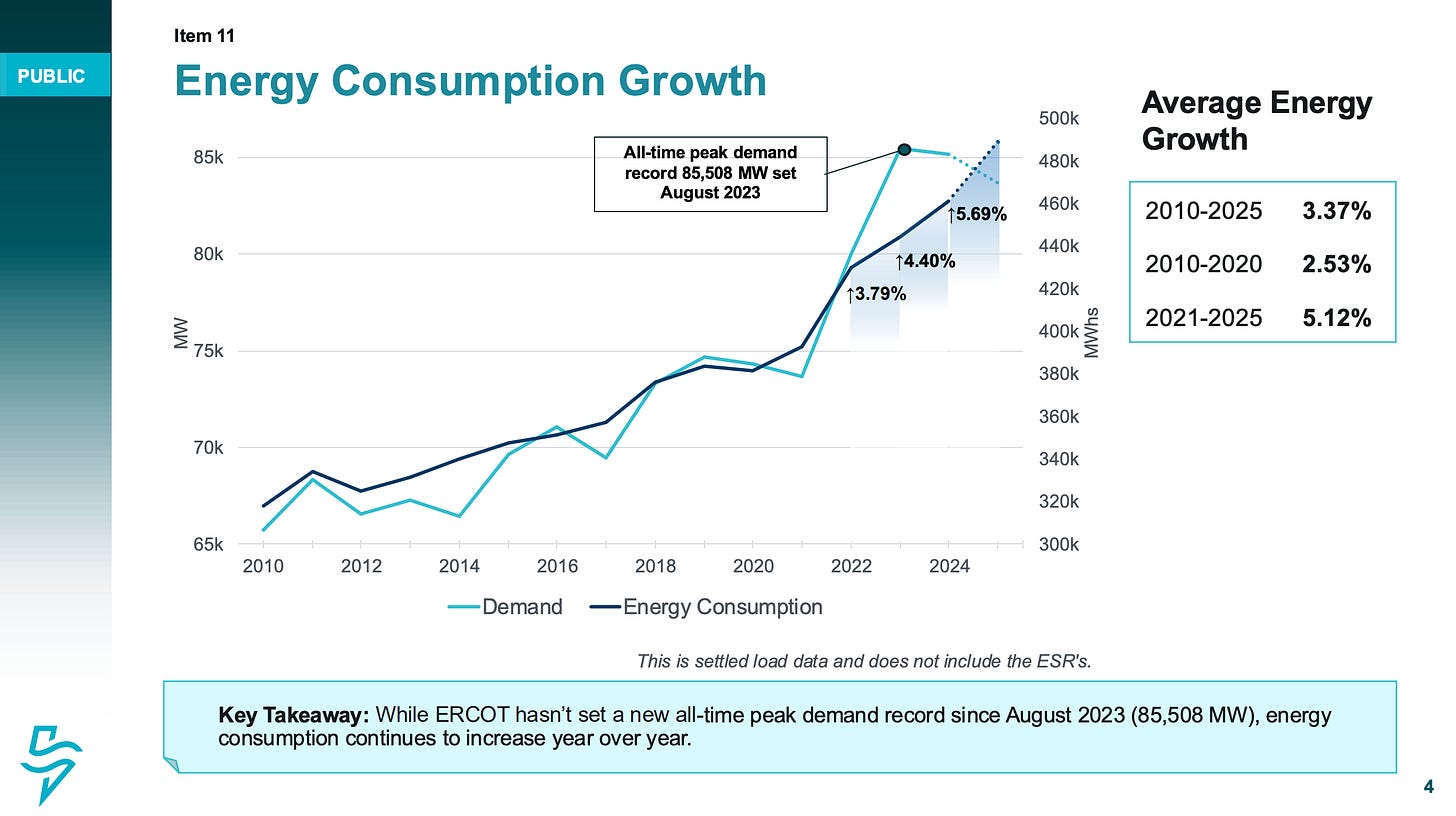

Yeah, before we go to Hayden, just kind of a thread to pull on there a little bit is, you know, there’s 190 gigs in the queue. I think part of the problem we’re having is everybody is talking about the gigawatts and not necessarily the gigawatt hours or terawatt hours, right? And we started to see that shift at the ERCOT board meeting last week, Pablo Vegas, CEO. And yesterday here, ERCOT Chair Bill Flores talked about the very same thing, showed the same slide that we are seeing increased use and consumption while demand has actually not increased the last couple of years. Part of that’s weather, but I think part of that is changing use patterns, which is something I think we’ll talk about a lot here, is like freeing up some headroom for some of those AI data centers. Hayden, what are you looking at for 2030?

Hayden Stanley (07:28.686)

Well, I mean, I think over the next five years, we’re certainly in a race to win the AI race. You know, that’s ultimately going to be enabled by power. You know, power is maybe one of the largest waves created by AI. Interestingly enough, it does enable it. So I think that that’s paramount that we achieve some of these goals. You know, when I think five years from now, I think that there’s going to be a lot of innovation that’s going to play a really big role. I think that there’s going to be a lot more, the grid’s become smarter, there’s going to be more communication, more alignment. You’re mentioning, like demand not increasing, but a lot more consumption that just seems like efficiency to me. And, you know, I think things like that are amazing. I think that we’re in a situation where I look at infrastructure maps a lot and I think there’s going to be a whole new layer added on. I don’t know if you guys play with those, but you turn on one layer, another, another. I think there’s a whole new layer of infrastructure that’s about to be added to the map. And it’s really exciting how all of that gets to be thought about and created and developed. So happy to be a part of it and try to help.

Doug Lewin (08:30.382)

It’s a fun time to be part of it. I love the way you said that, that just sounds like efficiency to me. Because I think part of what is happening with discussions on energy efficiency is that actually using more electricity can be energy efficient, right? Particularly if you’re using it for industrial purposes or transportation electrification. Like it’s a good thing to use more as long as you’re using it at the right times and as long as we can move it around. Tom.

Tom McGinn (08:53.686)

Yeah, I mean, I think we’re talking about just kind of lifting the system load factor as a whole, which, you know, hopefully has benefits downstream for recovery of system-wide costs. You know, I think maybe to take a slightly more pessimistic view of what the next five years might look like. You know, we heard previously the backlog around getting new thermal generation online, system loads going up. We’re likely to see kind of increased just base load heat rates at least just through the higher system load factor. Resiliency seems like it’s going to be a continued household concern. Part of me is concerned about what happens to the mass market in this kind of wave of new load. Are they going to get run over for lack of a better term? Are they not going to have adequate representation at some of these policy settings where they don’t have the sophistication to manage load like some of our other large load customers that we talked about today? Yeah, I guess I’m short term a little concerned about what that looks like. I think long term with the continued innovation and the investment in the grid and other technologies kind of coming down the pike here that we would expect to see kind of a return to the abundance that Texas consumers have enjoyed thus far.

Doug Lewin (10:12.224)

Yeah. And I appreciate that little dose of, I wouldn’t even call it pessimism, just like realism, right? That there are concerns for residential consumers. I don’t know. And it’s actually, I think it’s very smart. I wrote down something Chairman Gleason spoke here at this conference on Monday. And he said, we need to make sure consumers are empowered, not just protected. Right? So like consumer protection is in the DNA of every PUC, but how do you actually think about consumer empowerment? Consumers want to save on their bills. They want to be more resilient, as you said, which is probably a great tee up for Zach. Your customers want to be more resilient. Zach, no, just kidding. Start with the 2030 question. Yeah.

Zach Dell (10:52.462)

I’ll be honest, I and the team at BASE, we think a lot more about 2040 than we do about 2030. And there’s plenty of good reason to think about ‘26 and ‘27 and ‘28 and the near term, but our mission as a company is to drive price down and reliability up. And we’re not talking 5% improvements, we’re talking 50% improvements, right? I’m using round numbers here, but we want to make a really big impact on those two metrics. And so to do that, you’ve got to make large investments with a long-term time horizon. And I think there are really strong precedents for this kind of orientation in other parts of technology, right? You saw Uber do it in transportation, Amazon in commerce, SpaceX in aerospace. We’re taking a similar approach to energy where we’re making 10, 20 year investments, both in terms of the technology that we’re developing, but also in terms of how we think about policy. And I think that this long-term orientation, this long-term planning, whether it’s building factories and building engineering teams and working on new technology that’s never been done in this industry, or it’s kind of mapping the policy roadmap to what is the grid of 2040, 2050 look like. That’s where we spend our time less about the 18 months, 24 months, 36 month timeframe. So that’s kind of how we think about the problem.

Doug Lewin (12:04.014)

All right. So let’s come back to this side, Maura. I want to ask you something. I saw a quote you gave in Texas Monthly. It was an article about restructuring that Russell Gold did. He quoted you as saying, ERCOT doesn’t put up roadblocks, it removes them. Do you remember saying this?

Maura Yates (12:20.642)

When was this article? I might have a different response.

Doug Lewin (12:23)

‘23. That’s what I want to ask you. Is that still the case? And I’m curious, like what are the emerging technologies you’re working on? Where are there roadblocks that are actively being removed and you’re excited and where are there roadblocks that actually we need? There’s been a lot of talk here last couple of days about stakeholder process, collaboration, and I think ERCOT is a great place for that. So what are some of those roadblocks that need to be removed to get these next emerging technologies to market?

Maura Yates (12:47.628)

Sure, and I certainly don’t want to point fingers at ERCOT. ERCOT has a lot on their plate. I am not one of the projects that’s in the queue directly impacted by some of the stuff going on. It’s a broader issue outside of ERCOT. I think ERCOT is also sometimes maybe doesn’t get the right direction or other things. So certainly don’t want to take a controversial position on that. In terms of where these roadblocks are, I think the roadblock largely right now is in my eyes a process-driven roadblock, right? We again work on a lot of large load projects. Some of these large loads are located behind the meter, private use networks. Some are just large loads trying to get interconnected that might have been further along in the interconnect process and now are going through a restudy. And when I think about the challenges to getting our portfolio done, it’s really just clarity on what do we need to do? Like, what are the steps to get there and what is the process to get there? And it sounds like a very simple resolution, but I think everybody here who’s stuck in that would probably say, yeah. That’s what I don’t understand is what’s the process to get there. So it feels as if there needs to be some effort to really look at, again, I know I’m pointing out the obvious, people work on this every day, an overhaul to the process and how we approach this problem. You know, we’re going through standard or normal means, whether it’s the standard rulemaking process or other, I understand that there are regulatory requirements, but perhaps we approach this challenge differently. Everybody’s confused on how to move forward. Nobody’s quite sure on where projects stand. That seems to be the challenge right now, a large challenge. Maybe we look at that differently because it doesn’t seem like we have resolution in sight. And to us, that’s the biggest question. That’s the question of how many of those gigawatts get built, right? Like, that’s the question we’re all asking is what’s going to get built? And the question of what’s getting built is, I don’t quite know what’s getting studied or how I have to get this studied to understand what capacity I have so that I can actually go get lending and actually get it built by 2027 or by the timeline that I need. So to us, this is a process conversation. Like the innovation needs to happen from how we are deploying and how we are understanding what that process is to get a large project built.

Doug Lewin (14:56.674)

Yeah. And obviously when you said that a couple of years ago, right? Like these new data centers were kind of a gleam in everybody’s eye. It was starting to be talked about a little bit, but only barely.

Maura Yates (15:05.006)

Yeah, the technologies I was worried back in 2023, we were working a lot with everybody on the stage and having conversations about residential-sized technologies and how do we get an integrated home into the market, right? Something that wraps in the electricity bill, very similar to the value proposition Energy Well and BASE are offering. Like, how do we get those types of technologies into the market? To me, ERCOT still is the great playground to have those conversations. I think ERCOT and the DG, the DER space and the work that we’ve done over the past decade has been a really great welcoming space to bring these technologies.

Tom McGinn (15:40.344)

Smart meters are leaders to that, usually enabling technology that a lot of other markets don’t have.

Maura Yates (15:45.922)

We’ve done a great job at that and ERCOT’s done a great job at that and they have allowed a lot of innovation in that space and I love working on those technologies with these people for that reason. The challenge that we have again is back on large load right now and large load is shifting this market so dramatically because one data center is the equivalent of a huge aggregation.

Doug Lewin (16:05.646)

Yeah. And Tom, let’s actually go to you next sort of picking up on that. You were saying, did you say smart meters and Smart Meter Texas? So this is something I’ve been kind of obsessing about lately. I did a podcast with Sonnen and Blake Richetta, he had this great phrase where he said, shape load perfectly, inject energy optimally. I’ve been thinking about that a lot because that’s really what is going to happen on the resi side. There’s so much, I think in the common understanding and even in industry circles, they’re like, customers aren’t going to do this stuff because you’re asking them to do something when you’re talking about shaping load. A lot of that is going to be done by the very AI we’re talking about trying to accommodate. Can you talk a little bit about the innovation in mass market retail? You have a lot of experience in that area.

Tom McGinn (16:53.496)

Yeah, just to pick up on the thread that Maura started earlier, the smart meter ubiquity throughout the market, the way that ERCOT transparently settles load to those meters enables a lot of product design innovation, at least in our market. I think what we’ve moved to now, I think early product design that leveraged Smart Meter Texas was really build design-driven or, you know, things like TOU products, index products. We’ve moved past that. I think there’s some interesting learnings there, but you know, the future of leveraging this type of technology is I think going to be done by physical products that make the market participation of mass market customers effectively effortless or invisible to them. You know, Blake’s point about perfectly shaping load and optimally dispatching is I think kind of echoing the earlier point about lifting the system load factor. I think just more efficiently using the grid that we have. You know, Zach’s going to be able to go into much more detail about the specific battery operations behind a company like that. But I think they’re all related and whether it’s whole home batteries or whole circuit batteries that are starting to come to the market or smart thermostats or smart EV charging or any of the things like that. They’re all kind of sitting on the same baseline technology of optimizing interval-level usage to respond to price signals.

Doug Lewin (18:28.462)

And these are resources that we’ve barely tapped at all. Like even on cars, I’m kind of amazed at, this thing gets talked about a lot, but there’s more than, that’s a rough back of the envelope, but there’s probably about 20 to 25 gigawatt hours of batteries rolling around on four wheels in the state of Texas right now. And we’re just like charging them whenever.

Tom McGinn (18:46.19)

This is an opinion, but I think part of the reason we haven’t seen more done with that data is just that for the most part, people don’t want to think about this stuff. They get home from work and they turn on their stove or have to do their laundry. They don’t want to check the app for price signals. And so we’ve been lucky to have this kind of multi-year environment with a couple of hiccups of very low pricing, especially relative to the rest of the country. And so it hasn’t spurred the type of innovation that you may expect. I think recent challenges around resiliency and some concern about what future volatility looks like is leading to kind of a different approach now where we’ll see more physical products come to the market.

Doug Lewin (19:26.99)

So Zach, I think that’s like a perfect tee up to ask you about, you know, again, the last couple of days, there has been a very consistent theme through all the different sessions. It was in Hollub Blues’ keynote yesterday, flexibility, flexibility, flexibility, right? And so the demand side has this enormous potential. You guys are focused on that residential mass market. Can you talk a little bit about the flexibility that you’re bringing to market? Pick up on those themes of what are you seeing consumers actually want out of this? And also, I’m just interested also from you in kind of how the go-to-market is working as far as competitive versus vertically integrated, because I know you guys are doing some in both. So if you have a mind addressing that too.

Zach Dell (20:06.2)

Couple of questions there, I’ll try to touch on all of them. I think the panel kind of touched on this, what do customers want? This is a pretty simple question to answer. They want their bills to go down and their lights to stay on, right? So, price down, reliability up. And that’s really our North Star as a business. How do you achieve this kind of flexible, reliable outcome at the max? You have the biggest possible battery on the home. Right? So we make the biggest battery in the market. Our next generation battery will be an even larger battery. Right? So why? Well, because we want to add as much capacity to the grid as possible. That capacity can be used to take the home off the grid in times of high prices. That capacity can be used to serve the grid in the same times, but more capacity is better. Right? So that’s really how we think about it. I think it’s pretty straightforward in terms of go to market. The way we think about this is we have one technology stack, hardware, software, firmware, we can talk about that. It’s vertically integrated and we’re building a factory and all that fun stuff, but the whole technology stack is aimed at these North Stars of price down, reliability up. That’s true in our deregulated gen-tailer business, and that’s true in our utility partnership business, where we go provide that same technology stack, the hardware, the software, the firmware, to regulated utilities, and then they get to go deploy that technology in their service territory to do what? To drive prices down and to drive reliability up, right? So it’s the same value proposition, same technology stack, different business model. We think that the long-term future of the company actually is more so focused on being a technology vendor to the utilities than just a deregulated gen-tailer in Texas. And we’ll grow the gen-tailer business in Texas. We’ll do it in other markets. We might do it in other countries. But the vast majority of the grid in the United States and the world is regulated and for good reason, right? And we can talk about why. And so we want to be the preferred partner to those utilities and really their outsourced R&D function. So the technology is the same, the value proposition is the same, the business model is just a little bit different.

Doug Lewin (22:09.582)

And you just, I don’t know if you can’t answer this, can’t answer it, but the size of the batteries, you said they’re getting bigger. Like, what are we talking about?

Zach Dell (22:15.394)

Yep. So our current product is a 25 kilowatt hour system that we primarily, if there’s room and the customer wants it, which they typically do, we install in parallel. So it gets you to 50 kilowatt hours.

Doug Lewin (22:24.908)

You get a couple days even in fair weather.

Zach Dell (22:27.634)

Our next generation product is a 40 kilowatt hour battery that we again install in parallel often to get you to 80 kilowatt hours. So that’s massive amounts of capacity on a per home basis. And then we’ve recently announced our generator integrated product. So we actually have a portable generator integration for our current product where you can take a $500 portable generator that you can buy on Amazon and you can plug it into your BASE battery. Obviously that portable generator isn’t able to power the whole home, right? But the BASE battery is and you can use that generator to charge your battery to keep you powered through a long duration outage. So we’ll continue to develop new technology like this to extend duration, add more capacity on a per home basis, which we think really is the way to solve kind of both of these problems that you’re highlighting.

Doug Lewin (23:09.324)

Before we go to Hayden, just also just want to give folks a sense of the scale of this, because I sort of hear this a lot is like, well, we’re doing so many batteries on the bulk side. What is the demand side? Can you talk about the scale you’ve reached so far and kind of the pace you’re going at as far as adding this? Yeah.

Zach Dell (23:23.15)

We’re growing fast. We’ve got over 100 megawatt hours on the grid here in Texas, rapidly approaching 200 megawatt hours. We’re adding over 20 a month. We think around this time next year, we’ll be on the order of 100 a month. So we’re building a factory here in Austin, capable of four gigawatt hours a year. That’ll be our first factory, which is really kind of not a prototype factory, a way for us to, we think about things in terms of crawl, walk, run, right? So develop the technology, test it, then make sure it works, then scale it up. Factory one will be sizable, four gigawatt hours is not small. Factory two will be much larger. And we’re already thinking about that and making some investments in that direction that we’ll be able to talk more publicly about soon. Yeah, I mean, I think we’re the fastest growing battery developer in the state, certainly, and probably the country. And we’ll continue to grow at that deployment rate over the next couple of months.

Doug Lewin (24:11.022)

And part of my reason asking that question is just, I’m hoping to the audience in the room and to those that are listening to the podcast, the scale of this is really starting to, I’m hoping it’s starting to take hold with folks. Like the podcast I have coming out tomorrow, Travis Kavulla from NRG, they’ve got a one gigawatt VPP they’re working on. He said on that podcast, they were at, I think at 150 or something like that, 100, 150 somewhere in their megawatts already. You’ve obviously got Tesla out there, Swell and Octopus. We are starting to see gigawatt scale. There’s already six gigawatts of distributed assets already out there that ERCOT has measured. So when we’re talking about these large numbers of growth on the bulk system, we also need to be thinking about the distributed system as scaling. All right, Hayden, I want to ask you something sort of obviously related, but a little bit different and actually hasn’t been talked about a ton at the conference here, but you know, it’s a big deal in Texas and nationally is the repeal of the IRA. What does that mean for you guys and your changing business and sort of the pace and economics of building new gen in ERCOT?

Hayden Stanley (25:17.652)

Sure. Well, that’s a really easy one. I’ll take that one head on. Sure. So, you know, there’s probably folks that are on both sides of it, you know, on one side, you know, we want large degrees of security, on the other side, there’s a lot of people who just don’t want the rules to change. Yeah, you know, I understand both sides of people who want it and don’t want it. I’m really glad that I get to be in the position of someone who gets to respond rather than having to make the decision on the legislation. So I get to, you know, Monday morning quarterback over here, but you know, I think that ultimately what happens is it levels the playing field and in doing so it creates more competition and it allows there to just be a lot of innovation and the best business model wins and you get to figure out what that is. And that’s happening in real time and it allows, you know, smart and agile teams to be really creative and push innovation into the space. I think ultimately customers win whenever there’s a lot more competition. So that’s great. I think that, you know, in doing so we like to be highly competitive ourselves. The best way you can do that, serving power is you can either figure out ways to make more money or you can figure out ways to save money. And so figuring out ways that we can synergize our operations, we are vertical, we do our own EPC. We try to have the lowest net build cost out there. And so that’s really something that we really focus on. It’s easier to save a dollar than it is to earn one because earning one’s risky and other things.

Doug Lewin (26:41.432)

So you see one of the main things about the repeal of the IRA being sort of driving efficiency.

Hayden Stanley (26:44.85)

Driving efficiency, you know, that’s on one side. Efficiency is on one side of it. Cost savings is on one side of it. You know, another thing is, you know, we really focus on the DG level. So we’re deploying 9.9 megawatt assets and you know, would I rather have a 100 megawatt or 200 megawatt asset or 10, 10 megawatts or 20, 10 megawatts? I think I would take seven 10 megawatt sites over one 100 just because you get diversification of risk and the portfolio effect. But with that being said, we’re more so looking at this 9.9 megawatts of interconnection capacity as a resource. And, you know, the prior business models of the past are not set up for the future. And we are pairing resources. We are stacking advantages to be prepared for these non-scarcity years, such as 2024, 2025. We’re really focusing on the intrinsic value of the assets that we’re building. And if they’re not underwritable from an intrinsic view, it’s not something that we’re interested in. So we’re really trying to create more value and being more innovative in our own deployments in order to survive those years. You know, we somehow entered the data center space. We really couldn’t help ourselves. We came by, came across a site that has literally everything you need. 138, 345 kV lines, plus three natural gas pipelines, 20 minutes from a major metro area with a lot of acreage, right? It’s something that we’re like, hey, we’ve got to get involved with this. And even with everything on site, the data center world, it’s complex. It’s a very complex animal. And having to bring all the power behind the meter and the complexities of SB 6 and how the TSPs are viewing load versus co-located generation, it’s creating a scenario where you have to paint this power story and these systems are complex, especially getting them online. And so I think that I may have a view of ERCOT where, you know, maybe the demand story isn’t so bullish and maybe it’s a bit more bearish because there’s potential for delays for regulatory compliance and things of that nature. And what happens with all of these things, you know, it’s a lot of demand, but they’re all bringing really big plants behind them. What does that really look like? So we’re having the view into kind of that demand side with still building generation assets. We’re really preparing for non-scarcity years and really focusing on intrinsic value. And that’s kind of how, you know, a repeal of a certain regulation just kind of forces you to think differently across your entire business portfolio.

Doug Lewin (29:20.302)

All right. So in just a couple of minutes, we’ll go to questions from the audience. Before we do that, though, I want to also ask you, Maura, related to that, right? Hayden’s talking about a lot of the complexity that could really slow that down. I know that’s a lot of what you guys are dealing with. So you guys are putting together a dashboard to kind of look at all the different things that are going on. So what do you see as you’re talking to people out there as far as, what are those roadblocks? If you take more of a bearish case, you look ahead to 2030, like we haven’t built out as much data centers as we all maybe hoped or thought, what’s kind of got in the way. And that way we can sort of anticipate it and hopefully not let it happen.

Maura Yates (29:57.816)

Sure. So if we get to 2030 and we’re kind of cruising along still seeing the same steady load growth, I think one of the things we need to clearly continue to evolve is our data use and our data around some of these more remote sites. So one of the challenges we have is we’re seeing a lot of load growth in remote areas. And as a result, we don’t have the same quality of data that we were talking about earlier. We have wonderful quality of data on our residential loads, which is great because they drive a lot of the volatility in the market. We want to see how those behave. And again, the real-time behavior is really important on those. But at the same time, we also have a lot of these large loads and—sorry for being the large load voice on this panel—but we have a lot of these large loads where we don’t have data visibility and granular visibility into what’s happening. Not all these loads have an EPS meter or the right metering infrastructure for us to see that data even, you know, five days in arrears if they don’t have the telemetry or a QSE on site.

And so I think as we continue to move forward, we have to understand how we use data better and we get good data off really important assets. Again, that sounds like a really obvious point, but it’s not working well enough right now. So we need to continue to work on how we get data off some of these larger assets in the market. I think one of the other things that we want to be thinking through is also just—we spend a lot of time in legal and in contracting and how you create contracts that are nimble and grow and evolve with the market as there are uncertain times. I think, again, through all these large loads and working through contracts that perhaps have tenor that extends beyond this five years that we’re talking about. So how do you create a contract that is de-risked for all parties, able to go get lending, that also recognizes and acknowledges the market’s going to change in the next five years and we don’t know, and the market’s specifically going to change around things that impact your load? And so I think the other thing that we’re trying to focus on is the perfection of contracting and how you create the right contract and document set for a very, very boutique product. Every site has different needs. Every site has different lenders. Every site has different operations. So how do you evolve that contracting structure so that five years from now, you’ve got all these participants in the market who have been trying to get in for five years, but in a structure that supports reliability, supports performance, and doesn’t drive bankruptcies and a whole other kind of next generation of problems to solve.

Doug Lewin (32:22.04)

That’s really interesting. I think most people think about the data problems as being more on the residential side. Maybe it’s just me, maybe I’m just totally off base on this. I think of the big customers—data is something everybody’s got. But it’s a brave new world, right? These are developments, like you said, 800 megawatts. We haven’t seen anything like this.

Maura Yates (32:41.902)

We just launched a platform that we built off of our own internal operations because it’s how we look at data and we really care about how these large loads behave. And we really care about it at an interval basis. And when you don’t have that data at an interval basis, what’s the other data you need to look at? So it’s something that we think is super important and we’re trying to lend our learnings to the market to also have access to the best data available today.

Doug Lewin (33:06.584)

So before we go to the questions, anything y’all want to say in response to each other?

Tom McGinn (33:09.558)

I have a question about what you just brought up, if you don’t mind. So are you saying that, let’s say you have a very large load that is committed to be price responsive or something like that, let’s say you have a price spike, the large load curtails, but your initial data is going to show what?

Maura Yates (33:27.918)

Sometimes it shows in our large loads that that load never curtailed in our initial settles. And again, I’m not trying to put ERCOT in a hot spot, so please don’t take it that way. But sometimes based on the load profile, based on, again, the meter and the communication available at that site that’s available to the TDSP—it might not be the TDSP’s fault—that load, we won’t get actual meter data until that meter is read 30 days on the 30-day mark. And that’s when we actually see how it behaves. So our initial settles might not reflect the price-responsive load actually curtailing. It might actually be settled off of a profile settlement, which is, when you think about it, these are really large loads, a big piece of...

Tom McGinn (34:04.716)

Huge dollars on the initial settle, but you’re working capital flow to support that.

Doug Lewin (34:10.446)

All right. Okay. So let’s go to some of the questions here. Let’s see. So I’ll go with the one that’s upvoted the most in the room. No one seems to talk about the water issue. There seems to be a lack of water, which will prevent generation from coming online. It’s also—there’s water associated with data centers, obviously. So that’s a really good point. Water is often sort of overlooked. Does anybody want to take that one?

Maura Yates (34:30.893)

There’s a reason we haven’t talked about it, I guess. None of us want to—I’m not a developer. I’m going to absolutely punt to the developers of those assets. But I do know through the permitting process and through a lot of the AHJs, they’re looking at the water requirements. And I think there’s a lot of technical evolution in terms of cooling technologies out there to require less water.

Zach Dell (34:51.534)

Yeah, I’m certainly not an expert on this topic. There are some very smart people working on water problems in Texas. In fact, my sister is working on this and spending a lot of time thinking about it. Our generation technology requires 0.0 gallons of water. So there certainly are—I think the cooling point, Maura, is a good one. And that was a challenge that data centers face. If you’re looking—I mean, why is Northern Virginia a place where all these data centers go? There’s a bunch of things, there’s permitting things and real estate implications, but a lot of it is the climate. Texas is very hot, as we all know. You do have to cool down these GPUs and that does take a lot of water. But not all generation technologies do require water. Obviously data centers are not necessarily generation, they’re load obviously. So, but yeah, it’s a complicated problem and I certainly don’t have any...

Doug Lewin (35:32.12)

I do think it’s a really important point. It’s not actually talked about a lot with renewables and storage—that there really is minimal water there. Obviously water use is mostly agricultural and the power sector is a slice, but it’s—other than washing some panels and stuff like that, you do get major water savings from renewables. Do you want to say something on this one?

Hayden Stanley (35:53.006)

Sure. Yeah. A lot of the data centers are moving to closed-loop designs to alleviate that. They’re building these things in the desert, but on the power gen side, a lot of the behind-the-meter thermal—I mean there’s certainly a requirement where you need water to operate those.

Doug Lewin (36:09.056)

And I think the trade-off there, right? If you’re reusing the water, you’re going to use more power because you’ve got to keep that water cooled, right? So there are these trade-offs.

Hayden Stanley (36:17.964)

Right. And some assets use more than others do. So if you’re using different types of thermal, they require different levels of steam.

Doug Lewin (36:28.962)

All right, somebody’s asking a question of me that got upvoted. Is this a tough question? Should I ask myself? What would be your one policy you’d implement in Texas if you could? A carbon tax? No. Incentive for clean dispatchable resources? There has to be some ambitious policy post-IRA. What is it? So I would think probably half this group can probably guess what I’ll say, which would be a real focus on getting rid of resistance heat and putting in high-efficiency heat pumps. And I’d like to see that done with market-based solutions where we actually have some price discovery, where it’s not just like pick a price and pay this incentive. We don’t know, are we paying too much? Are we paying too little? Introduce some competition into the demand side. I’m supposed to be the moderator. Any—y’all want to say anything about that?

Tom McGinn (37:13.422)

I’ll echo your point. I agree with you. I think the resistance heating or just inefficient heating in general in the mass market space is a serious issue that we see in risk management and load forecasting and stuff like that. So I agree completely.

Doug Lewin (37:26.528)

And it very much relates to what we were talking about earlier with shaping load, perfectly adjusting energy optimally. You’re not shaping load perfectly if in the wintertime a house is using 10 kilowatts and an apartment’s using five kilowatts all through the night. We’re not shaping that load. And it’s those peaks that we’ve got to be able to manage to be able to bring data centers and all kinds of other stuff on. Okay. There’s one for Zach. Zach, when are you expanding to California?

Zach Dell (37:51.468)

We’re working on it. We will share more about our expansion plans outside of Texas in the coming months, but we’re talking to regulated utilities in a number of states that have expressed interest in our technology, California being near the top of the list. So I don’t have a firm date for you. My hope is 2026. I’m pretty confident that we’ll be able to—I’m quite confident that we’ll be moving outside of Texas in 2026. I’m hopeful that California will be one of those states because California is a place that obviously has a massive need for batteries given the penetration of solar.

Doug Lewin (38:19.662)

This is a question from the audience. The panel’s outlook is pretty bearish about demand growth in ERCOT, but bullish on the technological innovations on the supply side. Will the technology be deployed without the demand?

Maura Yates (38:29.39)

I think so. That’s what ERCOT is known for. Back to that earlier comment that I still stand by from 2023. ERCOT is the right place for experimenting with products and technology and testing how a market responds. I think as we introduce new price signals, we’ll start testing other ways new technologies behave with the RTC plus B. What does that do? Does that introduce new technical innovation? But I think we continue to be really right for that.

Tom McGinn (38:54.38)

Yeah, I don’t think anyone’s bearish on load growth. Load growth is already here, right? And so, I mean, the existing infrastructure is aging, load growth has happened. There’s questions about how much future load growth there will be, which I think are valid given the state of the interconnection queue. But yeah, I just wanted to push back on bearish load growth.

Hayden Stanley (39:15.33)

Yeah, I think that the projections are what? A hundred percent increase by five years or something crazy. So, I mean, I think that it’s the relative nature of it—maybe where we should backtrack the pace of this—but the growth is still going to be very, very, very high relatively. So I wouldn’t say the outlook is bearish.

Zach Dell (39:35.758)

Yeah, I would add, I would go back to the first point I made, which is we think more about 2040 than 2030. So yeah, we are going to continue building technology to drive price down and reliability up. And what happens next year and the following year matters, but is not really where we’re focused. We’re making long-term bets. And I think my hope is that other technology companies take the same approach because that has worked out really well in other industries.

Doug Lewin (39:55.982)

Yeah, I think the only bearishness you’re probably hearing is just like, how are all these rules around SB 6 going to get worked out? There’s a lot of uncertainty. Is that going to kind of slow things down? But to your point, a 25% increase—we were like 400 terawatt hours four years ago. We’re probably going to be just short of 500 terawatt hours in 2025. Again, I think we need to think big, like, you know, maybe even doubling that number in a six to ten year kind of a horizon, but really managing that peak. If we get to where we’re double the peak, but not triple the consumption, then we’ve done something very wrong. All right. Maura, Hayden, Tom, Zach, thanks for being here. Please join me in thanking the panel for a great discussion.

Thanks for tuning in to the Energy Capital Podcast. If you got something out of this conversation, please share the podcast with a friend, family member or colleague and subscribe to the newsletter at douglewin.com. That’s where you’ll find all the stories where I break down the biggest things happening in Texas energy, national energy policy, markets, technology, policy. It’s all there. You could also follow along on LinkedIn. You can find me there and on Twitter, Doug Lewin Energy, as well as YouTube, Doug Lewin Energy. Please follow me in all the places. Big thanks to Nathan Peavey, our producer, for making these episodes sound so crystal clear and good, and to Ari Lewin for writing the music. Until next time, please stay curious and stay engaged. Let’s keep building a better energy future. Thanks for listening.