AI Data Centers Aren't Causing Higher Prices: Reading & Podcast Picks, October 26, 2025

WaPo on rising electricity costs; Bordoff & O'Sullivan on "the energy weapon"; critical minerals mining in Texas; EIA on demand growth in Texas; backup power for nursing homes; and much more

Reading and Podcast Picks is a collection of what I’ve been reading and listening to over the last week or so about energy topics.

In addition to these R&P Picks, paid subscribers receive access to the full archives, Grid Roundups, and select episodes of the Energy Capital Podcast, and special presentations like Texas Power Rush. Please become a subscriber today.

There’s a reason electricity prices are rising. And it’s not data centers. Washington Post.

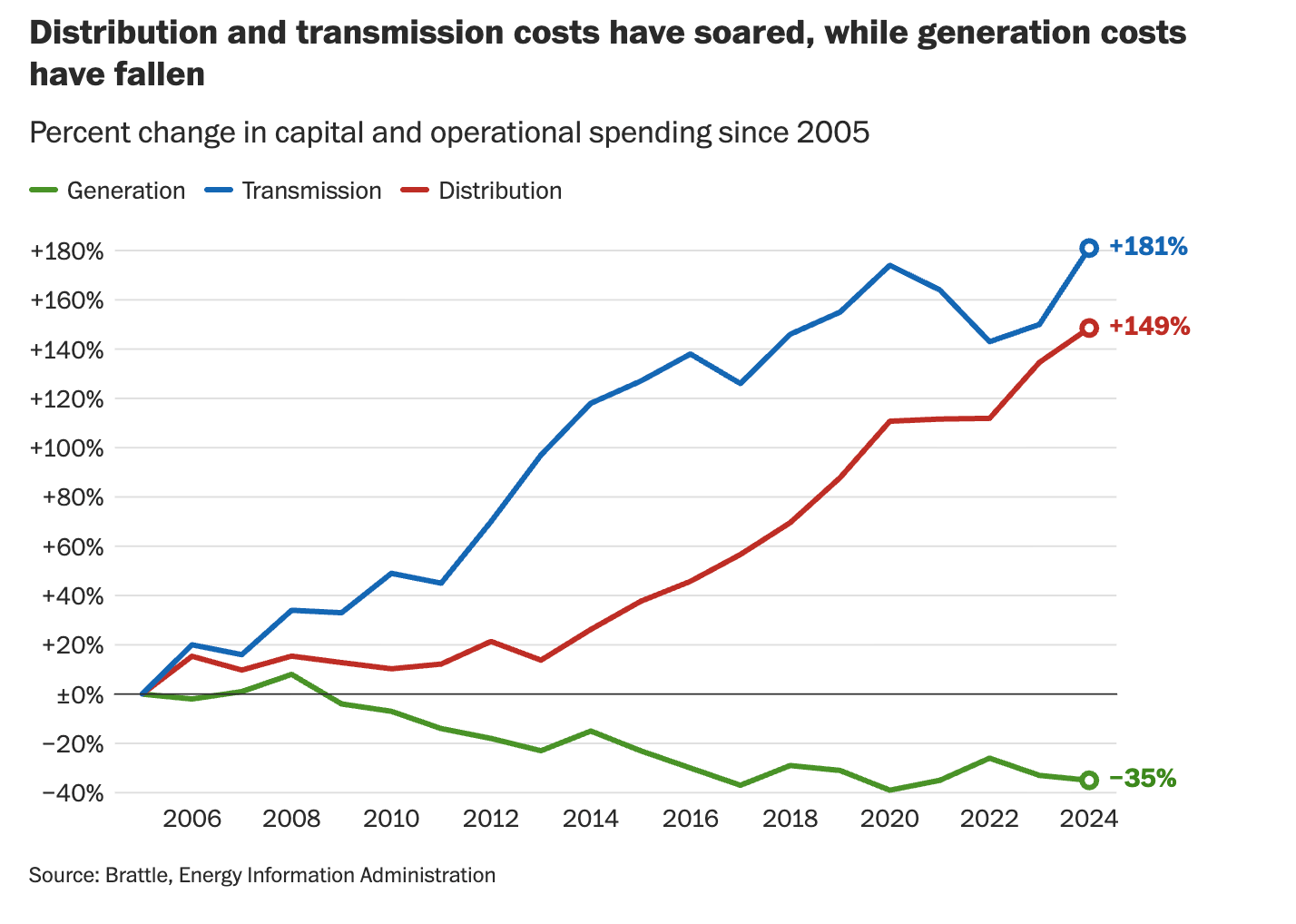

Electricity is complicated and there are many reasons why costs are going up by a lot in some places and by a little in others. The simplest answers are appealing and often wrong. I wrote last week about the excellent LBL/Brattle study on the causes of rising costs. Yesterday, the Washington Post covered the rising costs very well, including all the complexity and nuance.

One of the main things that is neglected in these discussions is that rising load growth can – but will not necessarily – make costs for residential and small commercial customers go down. That’s because the fixed costs of the system are spread out among more payers.

This goes back to the very earliest days of the industry when Sam Insull figured out that he could provide electricity to meat packing plants and electric trolleys in Chicago and bring down the cost of electricity for potential residential customers. This spreading around of costs is how electrification happened – and we would be wise to learn from the example as we electrify more and more areas of the economy and ways people use energy

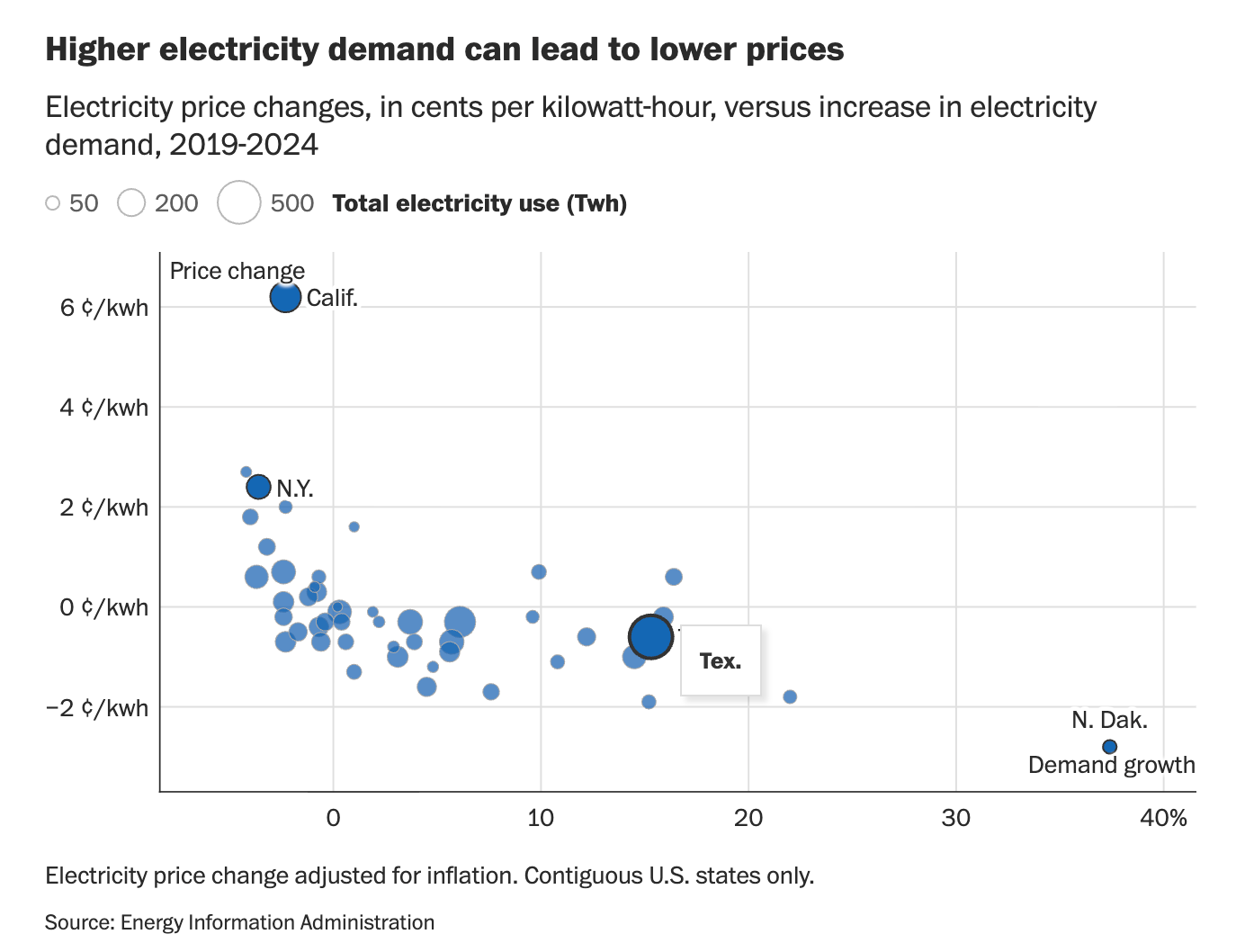

North Dakota, for example, which experienced an almost 40 percent increase in electricity demand thanks in part to an explosion of data centers, saw inflation-adjusted prices fall by around 3 cents per kilowatt-hour. Virginia, one of the country’s data center hubs, had a 14 percent increase in demand and a price drop of 1 cent per kilowatt-hour. California, on the other hand, which lost a few percentage points in demand, saw prices rise by more than 6 cents per kilowatt-hour.

That runs counter to traditional wisdom. Economics 101 teaches students that if demand rises, prices tend to go up. But electricity isn’t like any other economic market. Most of the costs in the system aren’t from pushing electrons through the grid, or what experts call variable costs. Instead, the largest costs are fixed costs — that is, maintaining the massive system of poles and wires that keeps electricity flowing. That system is getting old and is under increasing pressures from wildfires, hurricanes and other extreme weather.

“What that means is you can then take some of those fixed infrastructure costs and end up spreading them around more megawatt-hours that are being sold — and that can actually reduce rates for everyone,” Hledik said.

And of course, those fixed costs are much more transmission and distribution than generation:

For more on how growing demand can lower costs, see this article:

The More Things Change…

Insull quickly figured out he could sell power very cheaply during the daytime.. He used cheap pricing to induce demand, offering power for up to 90% less during the day. Factories and electric streetcar companies happily took the offer, and the added revenues and profits helped him greatly expand the early electric grid.

The Return of the Energy Weapon: An Old Tool Creating New Dangers, Foreign Affairs

Jason Bordoff and Meghan O’Sullivan provide extremely important historical context to what’s happening in the energy world over the last few years. Bordoff worked for Obama and O’Sullivan for Bush on national security; their collaboration here is incredibly illuminating.

Energy was used as a weapon in both World Wars and again by OPEC in the 1970s. With a few exceptions, energy wasn’t used much as a weapon over the last 50 years – until this decade. And now several countries, including Russia, Canada, the US, and China are attempting to use “the energy weapon.”

Can’t recommend this one highly enough.

If you prefer podcasts to long articles, the Columbia Energy Exchange podcast is a great listen:

As a perfect complement to O’Sullivan and Bordoff’s piece on the energy weapon and supply chain risks involving China, US companies are getting serious about mining for critical minerals and rare earths in the US.

Keep reading with a 7-day free trial

Subscribe to The Texas Energy and Power Newsletter to keep reading this post and get 7 days of free access to the full post archives.