Market-Based Renewables Lower Prices, Reading & Podcast Picks, October 19, 2025

Batteries are booming in Texas; LBL/Brattle study shines light on factors driving power prices; reckoning with China's growth; Corpus Christi is running out of water; and much more

Reading and Podcast Picks is a collection of what I’ve been reading and listening to over the last week or so about energy topics.

In addition to these R&P Picks, paid subscribers receive access to the full archives, Grid Roundups, and select episodes of the Energy Capital Podcast, and special presentations like Texas Power Rush. Please become a subscriber today.

The Great Reckoning by Kaiser Kuo- The Ideas Letter

This is a tough read, but a must read.

In conversations I’ve had over the last few months in Beijing with professionals spanning various industries, from biotech to automotive, from renewable energy to humanoid robotics, I’ve heard variations of the same observation: The transformation that has swept through their sectors in China over the past two decades—or even just the past five years—would be utterly unfathomable to anyone who hasn’t witnessed it firsthand. They describe returning from conferences in the United States or Europe struck by a disconnect: The tsunami of transformation coming from China just isn’t felt with an urgency remotely commensurate with the scale of the disruption in store.

If you’re talking or writing about energy and not talking about what China’s doing, then you’re simply not comprehending the scale and the magnitude of what they’ve achieved. It’s extraordinary and probably without parallel — or at least with very few parallels — in the history of the world.

In the US, we have started — just begun really — to reckon with this fact:

… the painful recognition that another system, however flawed, has delivered results on a scale that the United States has not. This is to me, as an American, a source of not inconsiderable anguish. I take no pleasure in witnessing what my country has become—a nation I love, torn apart by political tribalism so intense and so toxic that I fear it may be beyond repair, at least in the coming, and critical, decade.

But confronting this crisis requires looking squarely at what seems so unsettling about China’s success. As Chas W. Freeman, a retired senior U.S. diplomat, has observed, “Americans now exhibit an odd combination of self-doubt, complacency, and hubris”— a mix that has prevented the kind of clear-eyed assessment the moment requires.

We are in denial about how rapidly China is outpacing us in energy: building a terawatt of power every two or three years while we’re on pace to add a terawatt… in two decades.

And they’re exporting not only solar panels and wind turbines and batteries all over the world, but EVs, too — the Chinese are absolutely dominating that industry globally. We have not yet reckoned with much of this. But we need to — and fast.

This presentation is one of the most important and useful presentations you’ll see this year. There are many reasons why electricity costs go up or down: it defies simple explanations.

But we can find some signal in the noise of data, summarized here. One of those: “market-based” wind and solar drive prices down. It’s astounding to me that some still dispute this. Extreme weather and the need to harden the grid drive prices up. Higher natural gas prices increase electricity prices and vice versa:

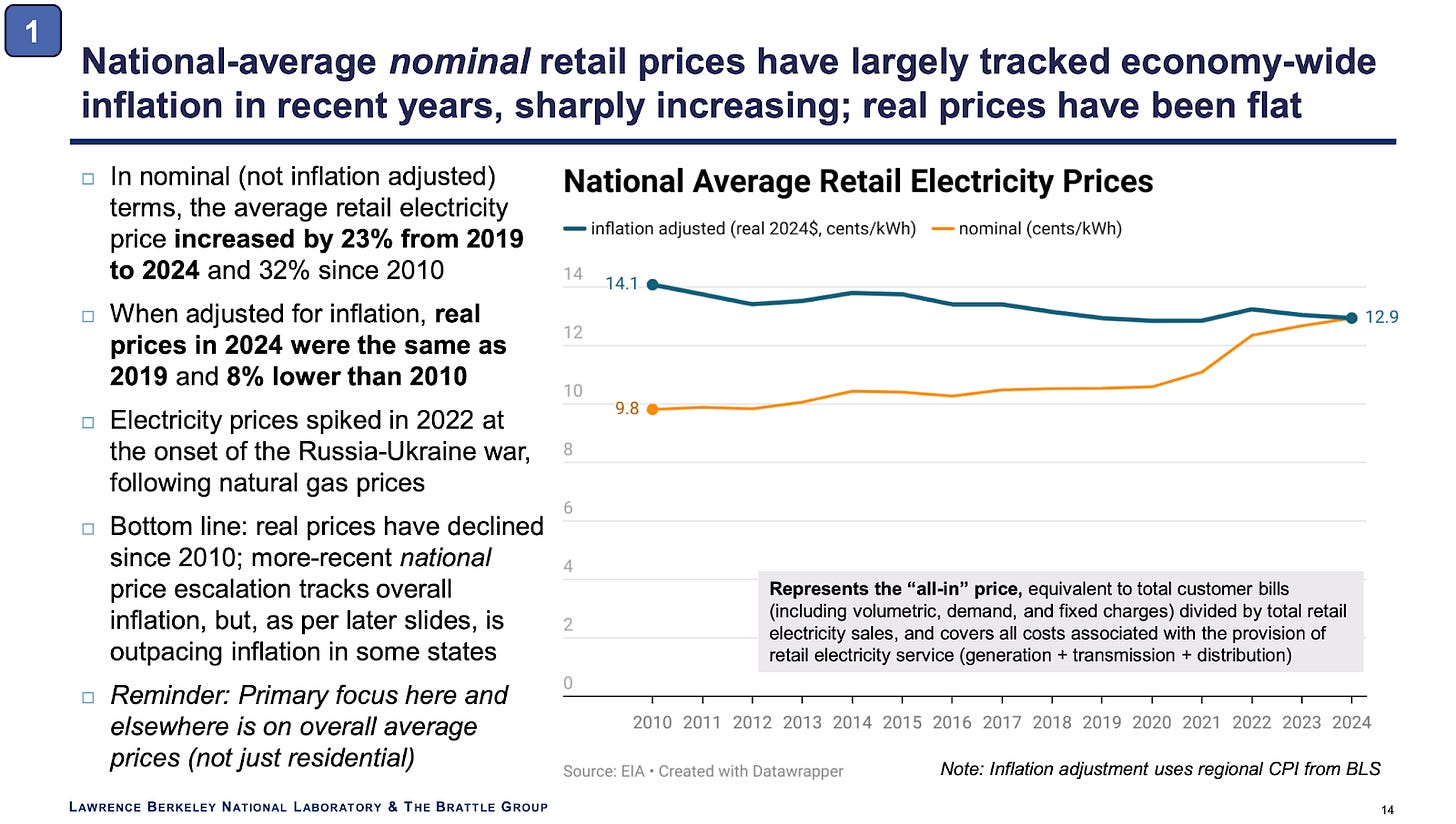

Other key takeaways: the charts you see with sharply increasing cost curves for electricity do not factor in inflation and don’t take a long enough view. Adjusted for inflation, the national average for electricity prices in 2024 was less than in 2010.

But that’s an average. Residential customers have seen higher cost increases than large commercial and industrial customers:

Keep reading with a 7-day free trial

Subscribe to The Texas Energy and Power Newsletter to keep reading this post and get 7 days of free access to the full post archives.