A Texas Flex, Reading & Podcast Picks, November 16, 2025

More AI data centers coming to Texas and it's only the beginning; distributed flexibility markets & DERs are a solution to multiple energy problems; gas prices rise as winter approaches; and more

Reading and Podcast Picks is a collection of what I’ve been reading and listening to over the last week or so about energy topics.

In addition to these R&P Picks, paid subscribers receive access to the full archives, Grid Roundups, and select episodes of the Energy Capital Podcast like this one on building a domestic solar industry with T1’s Daniel Barcelo.

Google data centers totaling $40 billion coming to Texas, Texas Tribune

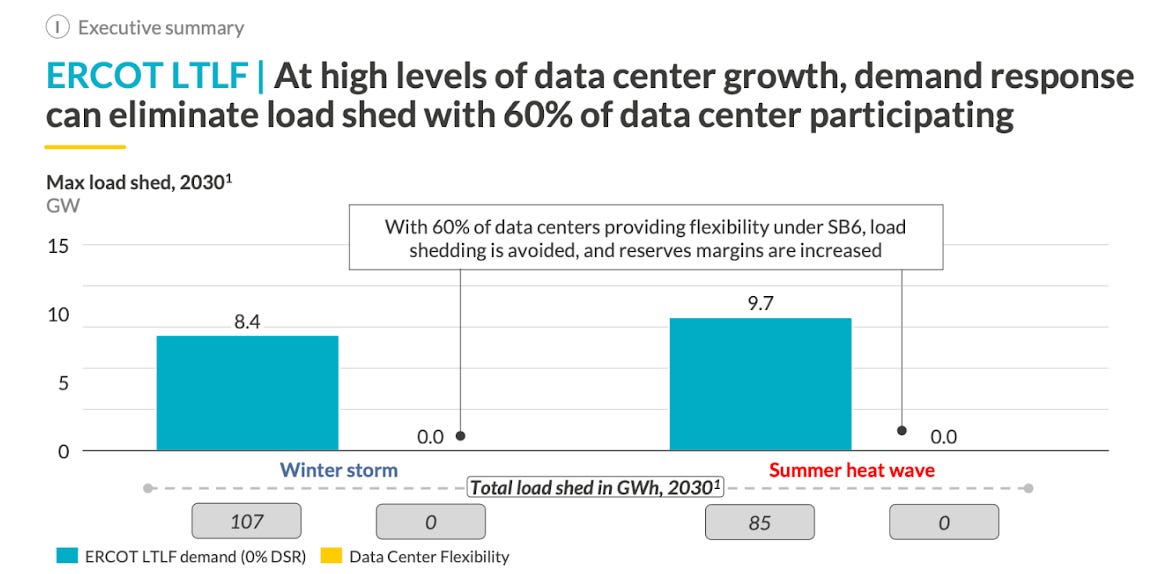

As I wrote about this week, ERCOT hired Aurora Energy Research to run models of strategies to reduce the likelihood of rolling outages in a 2023-like heat wave or 2022-like winter storm.

There was one scenario that had zero rolling outages: high demand growth from data centers with high levels of flexibility.

The same week the report came out, Google CEO Sundar Pichai and Governor Abbott appeared on a stage together to announce $40 billion in investment including 6.2 gigawatts of incremental supply and a fund for energy efficiency, which was highlighted in Governor Abbott’s statement:

“Texas is the epicenter of AI development, where companies can pair innovation with expanding energy,” Abbott wrote in a statement. “Google’s $40 billion investment makes Texas Google’s largest investment in any state in the country and supports energy efficiency and workforce development in our state. We must ensure that America remains at the forefront of the AI revolution, and Texas is the place where that can happen.”

When AI Hype Meets AI Reality: A Reckoning in 6 Charts | The Wall Street Journal (gift link)

Texas will clearly be a major destination for data centers. The WSJ had a great piece breaking down the realities of supply constraints facing AI developers:

The rate at which tech companies and startups are investing in AI shows no signs of slowing. In their latest financial reports, all of the big spenders revealed that their current investments had grown significantly, and projected that this trend would continue.

There is effectively “infinite” money available right now to build out new data centers, says Jim Schneider, a senior research analyst at Goldman Sachs. All this investment has translated into record spending on the stuff that goes into data centers—aka “AI supercomputers”—all those chips, servers, HVAC systems, transformers, gas turbines, power lines and power plants.

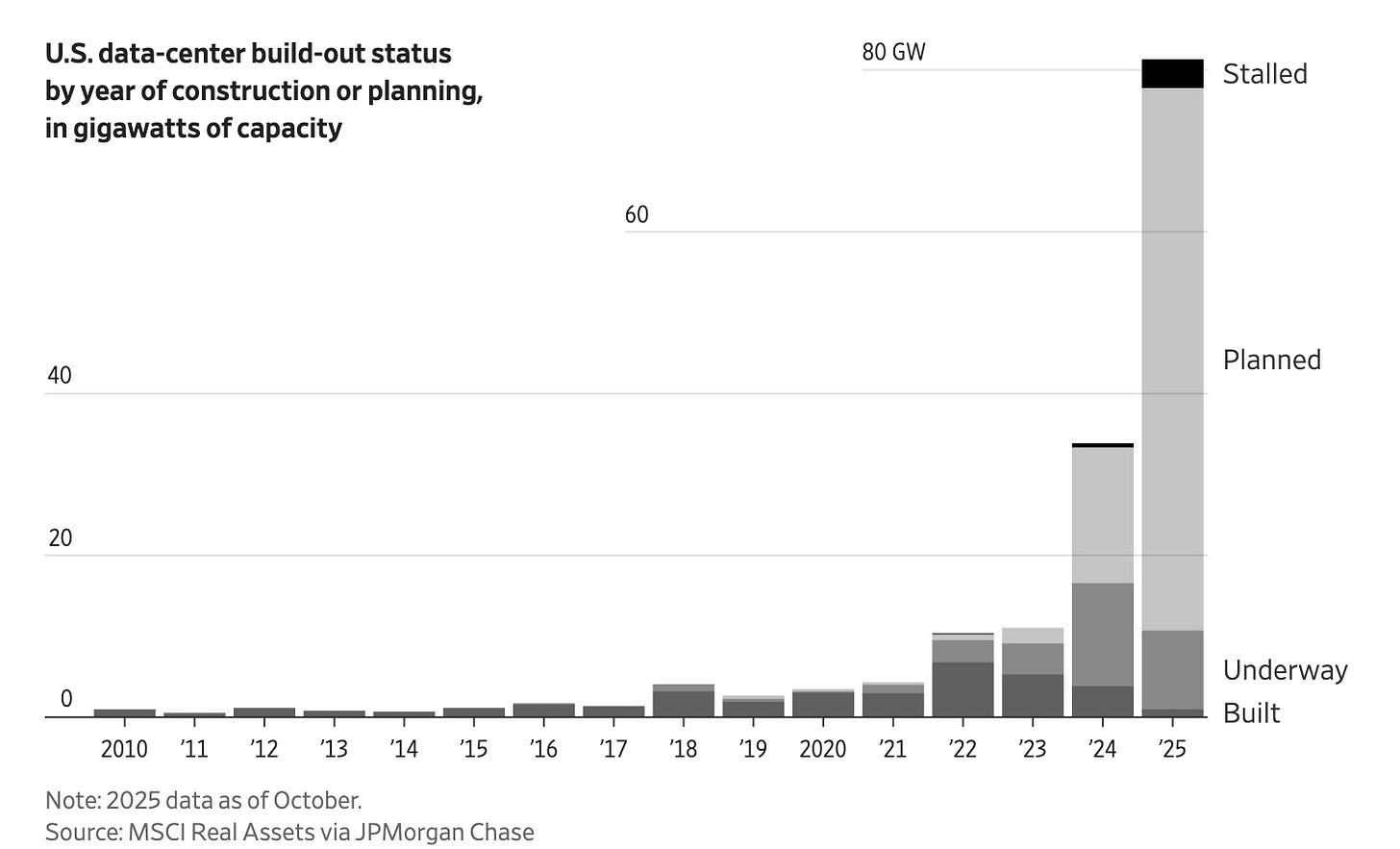

Today’s record number of data centers at the planning stage is indicative of what Raymond James managing director Frank Louthan calls “kind of a gold rush mentality.” Connecting these planned data centers to power and fiber, and finding a buyer or tenant who wants one, in that particular location is another matter.

As the chart shows below there’s about 70 gigawatts of planned power capacity in 2025 alone. Next year will almost certainly be even bigger.

The high load growth scenario modeled by Aurora was for 22 gigawatts in Texas over the next five years.

Read my latest from last week:

How to make a market for distributed energy flexibility | Volts

This is a must listen and builds on many of the great podcasts David has done on this in the past.

There’s huge potential for data centers to purchase demand reductions from residential and small commercial customers in flexibility markets.

Keep reading with a 7-day free trial

Subscribe to The Texas Energy and Power Newsletter to keep reading this post and get 7 days of free access to the full post archives.